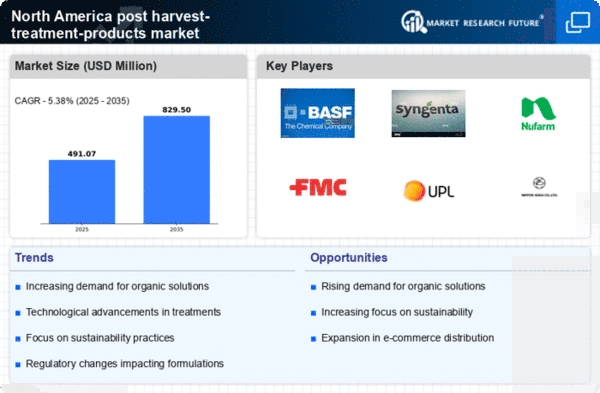

Growth of Organic Produce

The organic produce segment is witnessing substantial growth in North America, which is positively influencing the post harvest-treatment-products market. As consumers increasingly opt for organic options, producers are required to implement specific post-harvest treatments that align with organic standards. This shift is reflected in the organic food market, which is expected to reach $70 billion by 2027. Consequently, the post harvest-treatment-products market must adapt to these changing consumer preferences, focusing on organic-compatible treatments that ensure product quality while adhering to regulatory requirements. This trend presents both challenges and opportunities for market players.

Rising Awareness of Food Safety

Food safety concerns are becoming increasingly prominent in North America, significantly impacting the post harvest-treatment-products market. Consumers are more informed about the risks associated with foodborne illnesses, prompting a demand for safer food handling and storage practices. This heightened awareness has led to stricter regulations and standards for food safety, compelling producers to invest in effective post-harvest treatments. The market for food safety solutions is projected to grow, with estimates indicating a potential increase of 10% annually. As a result, the post harvest-treatment-products market is likely to expand as stakeholders prioritize safety and quality in their offerings.

Increasing Demand for Fresh Produce

The post harvest-treatment-products market in North America experiences a notable surge in demand for fresh produce. Consumers increasingly prioritize quality and freshness, leading to a heightened focus on effective post-harvest treatments. This trend is driven by the growing awareness of health benefits associated with fresh fruits and vegetables. According to industry reports, the fresh produce market in North America is projected to reach approximately $100 billion by 2026, indicating a robust growth trajectory. As a result, the post harvest-treatment-products market is likely to benefit from this increasing demand, as producers seek to enhance the shelf life and quality of their products to meet consumer expectations.

E-commerce Expansion in Food Distribution

The rise of e-commerce in food distribution is reshaping the landscape of the post harvest-treatment-products market in North America. As online grocery shopping becomes more prevalent, the demand for efficient post-harvest treatments that ensure product quality during transit is increasing. E-commerce platforms require reliable solutions to maintain the freshness and safety of perishable items, leading to a growing market for innovative treatments. Industry forecasts suggest that the e-commerce food market could reach $100 billion by 2025, indicating a significant opportunity for the post harvest-treatment-products market to cater to this evolving distribution model.

Technological Innovations in Preservation

Technological advancements play a crucial role in shaping the post harvest-treatment-products market in North America. Innovations in preservation techniques, such as modified atmosphere packaging and advanced refrigeration methods, are becoming increasingly prevalent. These technologies not only extend the shelf life of perishable goods but also maintain their nutritional value and appearance. The market for these technologies is expected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 8% over the next five years. Consequently, the post harvest-treatment-products market is likely to see a rise in the adoption of these innovative solutions, enhancing the overall efficiency of the supply chain.