Rising Export Opportunities

The expansion of export markets for French agricultural products is a key driver of the post harvest-treatment-products market. France is one of the leading exporters of fruits and vegetables in Europe, and the demand for high-quality produce in international markets is increasing. To maintain competitive advantage, French producers are adopting advanced post harvest-treatment-products to ensure their products meet international quality standards. Recent statistics indicate that French agricultural exports have increased by 10% in the last year, further emphasizing the need for effective post harvest treatments. This trend is likely to bolster the post harvest-treatment-products market as producers seek to enhance the quality and longevity of their exports.

Consumer Awareness and Education

Consumer awareness regarding food safety and quality is becoming increasingly pronounced in France, thereby impacting the post harvest-treatment-products market. Educational campaigns about the benefits of proper post harvest handling and treatment are gaining traction, leading to a more informed consumer base. This heightened awareness is prompting retailers and producers to invest in better post harvest-treatment solutions to meet consumer expectations. Surveys indicate that approximately 70% of French consumers are willing to pay a premium for products that are treated with safe and effective post harvest methods. This shift in consumer behavior is likely to drive growth in the post harvest-treatment-products market as stakeholders adapt to these changing preferences.

Increasing Demand for Fresh Produce

The rising consumer preference for fresh and organic produce in France is driving the post harvest-treatment-products market. As health consciousness grows, consumers are increasingly seeking fruits and vegetables that are free from chemical residues. This trend has led to a surge in demand for post harvest-treatment-products that enhance the shelf life and quality of fresh produce. According to recent data, the market for organic fruits and vegetables in France has expanded by approximately 15% annually, indicating a robust growth trajectory. Consequently, producers are investing in advanced post harvest-treatment technologies to meet this demand, thereby propelling the post harvest-treatment-products market forward.

Regulatory Compliance and Standards

The evolving regulatory landscape in France is a significant driver of the post harvest-treatment-products market. Stricter regulations regarding food safety and quality are compelling producers to adopt advanced post harvest treatments to comply with these standards. The French government, in alignment with EU regulations, has implemented guidelines that necessitate the use of specific post harvest-treatment-products to ensure the safety and quality of food products. This regulatory pressure is likely to increase the demand for innovative post harvest solutions, as producers strive to meet compliance requirements. As a result, the post harvest-treatment-products market is expected to grow as stakeholders invest in technologies that align with these regulations.

Technological Innovations in Preservation

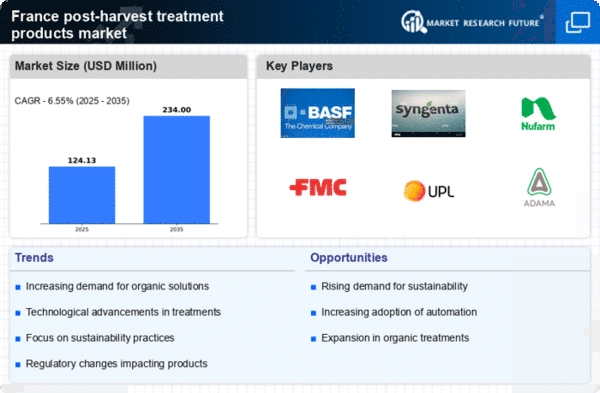

Technological advancements in preservation methods are significantly influencing the post harvest-treatment-products market. Innovations such as modified atmosphere packaging (MAP) and ethylene management systems are becoming increasingly prevalent among French producers. These technologies help in extending the shelf life of perishable goods, thereby reducing waste and enhancing profitability. The French government has also been supportive of these innovations, providing funding for research and development in agricultural technologies. As a result, the post harvest-treatment-products market is likely to witness a compound annual growth rate (CAGR) of around 8% over the next five years, driven by these technological improvements.