Increased Data Generation

The personal entry-level-storage market experiences a surge in demand due to the exponential growth of data generation across various sectors. With individuals and small businesses producing vast amounts of data, the need for affordable storage solutions becomes paramount. In North America, it is estimated that data generation will reach 175 zettabytes by 2025, creating a pressing requirement for entry-level storage options. This trend indicates that consumers are seeking cost-effective solutions to manage their data efficiently. As a result, manufacturers are focusing on developing products that cater to this growing need, thereby driving the personal entry-level-storage market forward. The increasing reliance on digital platforms for personal and professional use further amplifies this demand, suggesting a robust growth trajectory for the industry in the coming years.

Rising Consumer Awareness

Consumer awareness regarding data security and management is on the rise, which positively impacts the personal entry-level-storage market. As individuals become more informed about the risks associated with data loss and breaches, they are increasingly investing in storage solutions that provide enhanced security features. In North America, surveys indicate that over 60% of consumers prioritize data protection when selecting storage devices. This heightened awareness drives demand for entry-level storage options that offer reliable security measures, such as encryption and backup capabilities. Manufacturers are responding to this trend by incorporating advanced security features into their products, thereby attracting a broader customer base. The personal entry-level-storage market is likely to see sustained growth as consumers continue to prioritize data safety in their purchasing decisions.

Shift Towards Remote Work

The personal entry-level-storage market is significantly influenced by the ongoing shift towards remote work arrangements. As more individuals work from home, the necessity for reliable and accessible storage solutions has intensified. In North America, approximately 30% of the workforce is now engaged in remote work, leading to an increased demand for personal storage devices that can accommodate work-related data. This trend suggests that consumers are prioritizing storage solutions that offer portability and ease of access. Consequently, manufacturers are likely to innovate and enhance their product offerings to meet the evolving needs of remote workers. The personal entry-level-storage market is thus positioned to benefit from this shift, as individuals seek to optimize their home office setups with efficient storage solutions.

Integration of Smart Features

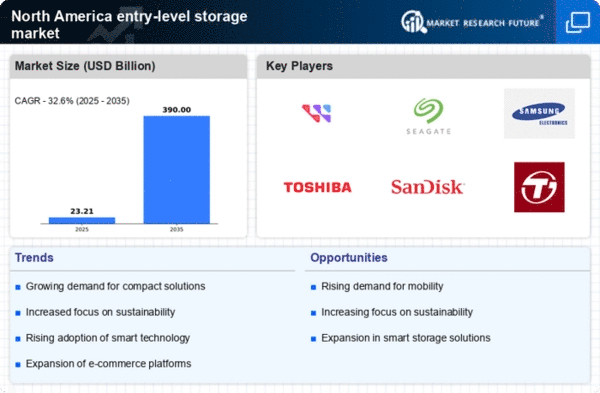

The integration of smart features into personal storage devices is emerging as a significant driver in the personal entry-level-storage market. As technology evolves, consumers are increasingly drawn to storage solutions that offer enhanced functionality, such as cloud connectivity and mobile access. In North America, the demand for smart storage solutions is projected to grow by 25% over the next few years, reflecting a shift in consumer preferences. This trend indicates that manufacturers are likely to invest in developing products that incorporate smart technology, allowing users to manage their data more efficiently. The personal entry-level-storage market is thus poised for growth as consumers seek innovative solutions that align with their digital lifestyles, emphasizing the importance of adaptability in storage technology.

Affordability and Accessibility

Affordability remains a critical driver in the personal entry-level-storage market, particularly in North America. As consumers seek budget-friendly storage solutions, manufacturers are compelled to offer products that balance cost and functionality. The average price of entry-level storage devices has decreased by approximately 15% over the past few years, making them more accessible to a wider audience. This trend suggests that consumers are more willing to invest in personal storage solutions, knowing they can find reliable options within their budget. Additionally, the proliferation of e-commerce platforms has made it easier for consumers to compare prices and find the best deals on storage devices. As affordability continues to be a key consideration, the personal entry-level-storage market is expected to thrive, catering to the needs of cost-conscious consumers.