Increased Construction Activities

The North America HVAC Insulation Market is experiencing growth due to a surge in construction activities across residential and commercial sectors. The ongoing urbanization and population growth in major cities are driving the demand for new buildings, which in turn increases the need for effective insulation solutions. According to recent data, the construction industry in North America is projected to grow by 6% annually, leading to a corresponding rise in the demand for HVAC insulation products. This growth is further supported by government investments in infrastructure projects, which are expected to enhance the overall market landscape for insulation materials.

Rising Awareness of Indoor Air Quality

The North America HVAC Insulation Market is significantly influenced by the growing awareness of indoor air quality (IAQ) among consumers. As people become more health-conscious, there is an increasing demand for insulation materials that not only provide thermal efficiency but also contribute to better IAQ. Products that are low in volatile organic compounds (VOCs) and have superior moisture control properties are gaining traction. This trend is likely to drive innovation in the insulation sector, with manufacturers focusing on developing products that meet these health standards. The market for insulation materials that enhance IAQ is expected to grow by approximately 3% annually, reflecting the changing priorities of consumers.

Regulatory Support for Energy Efficiency

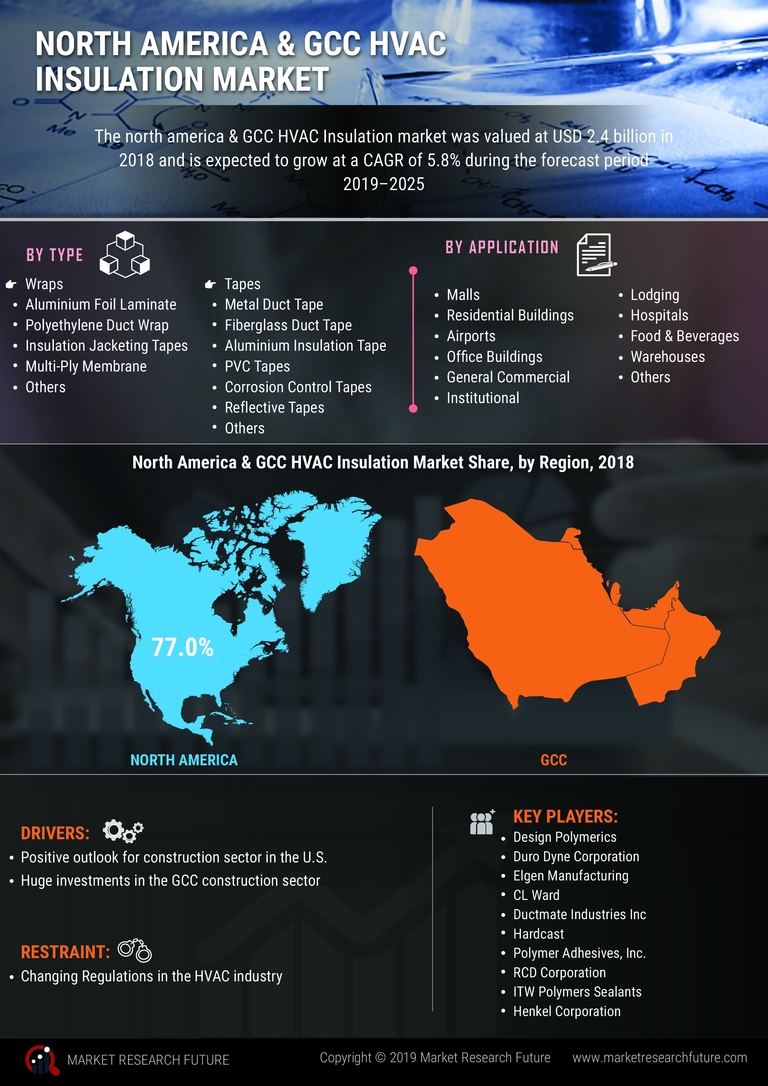

The North America HVAC Insulation Market benefits from stringent regulations aimed at enhancing energy efficiency. Government initiatives, such as the Energy Policy Act, promote the use of high-performance insulation materials. These regulations encourage manufacturers to innovate and produce insulation products that meet or exceed energy efficiency standards. As a result, the market is witnessing a shift towards advanced insulation solutions that not only comply with regulations but also provide long-term cost savings for consumers. The market size for insulation products in North America is projected to reach approximately USD 5 billion by 2026, driven by these regulatory frameworks that incentivize energy-efficient building practices.

Growing Demand for Sustainable Building Practices

The North America HVAC Insulation Market is increasingly influenced by the rising demand for sustainable building practices. Consumers and businesses are becoming more environmentally conscious, leading to a preference for insulation materials that are eco-friendly and recyclable. This trend is reflected in the growing adoption of materials such as cellulose and fiberglass, which are derived from renewable resources. The market is expected to expand as more construction projects incorporate sustainable practices, with a projected growth rate of around 4% annually through 2026. This shift not only addresses environmental concerns but also aligns with the broader goals of reducing carbon footprints in the construction sector.

Technological Innovations in Insulation Materials

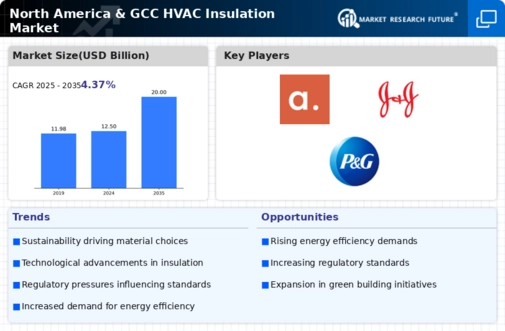

Technological advancements are playing a pivotal role in shaping the North America HVAC Insulation Market. Innovations such as reflective insulation, spray foam, and advanced fiberglass composites are enhancing the performance and efficiency of insulation products. These technologies improve thermal resistance and reduce energy consumption in HVAC systems, making them more appealing to consumers. The market is witnessing a surge in demand for these innovative solutions, with a notable increase in the adoption of spray foam insulation, which is expected to grow by 5% annually. This trend indicates a shift towards more effective insulation solutions that cater to the evolving needs of the construction industry.