Rising Crop Yields and Quality

The North America Biostimulants Market is significantly influenced by the need for increased crop yields and quality. As global food demand continues to rise, farmers are under pressure to enhance productivity while maintaining quality standards. Biostimulants have been shown to improve crop performance by enhancing growth rates and stress tolerance. Studies indicate that the application of biostimulants can lead to yield increases of up to 20% in certain crops. This potential for improved yields is driving farmers to adopt biostimulants as a viable solution to meet market demands. As a result, the industry is likely to witness sustained growth as more agricultural producers recognize the benefits of these products.

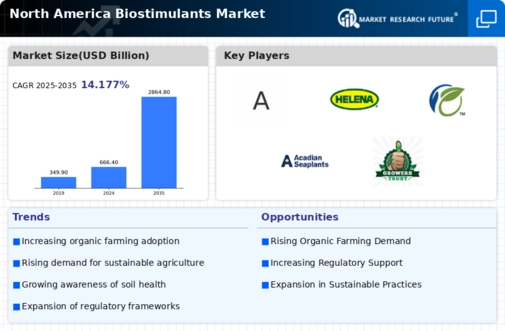

Growing Awareness of Soil Health

There is a rising awareness among farmers and agricultural stakeholders regarding the importance of soil health, which is a crucial driver for the North America Biostimulants Market. Healthy soil is essential for sustainable crop production, and biostimulants play a vital role in enhancing soil fertility and microbial activity. Research indicates that biostimulants can improve nutrient uptake and resilience against environmental stressors, which is increasingly recognized by the agricultural community. This awareness is leading to a greater acceptance of biostimulants as a necessary component of soil management practices. Consequently, the market is expected to expand as more farmers integrate biostimulants into their soil health strategies.

Government Initiatives and Funding

The North America Biostimulants Market benefits significantly from various government initiatives aimed at promoting sustainable agricultural practices. Federal and state governments are increasingly providing funding and support for research and development in biostimulant technologies. For instance, the USDA has allocated millions in grants to support innovative agricultural practices, including the use of biostimulants. This financial backing not only encourages the development of new products but also aids in the commercialization of existing biostimulant solutions. As a result, the market is likely to see an influx of innovative biostimulant products that meet the evolving needs of farmers, thereby enhancing the overall growth of the industry.

Technological Innovations in Biostimulant Formulations

Technological advancements in biostimulant formulations are emerging as a key driver for the North America Biostimulants Market. Innovations in product development, such as the use of advanced extraction techniques and formulation technologies, are enhancing the efficacy and application of biostimulants. These innovations are leading to the creation of more effective products that can be tailored to specific crops and environmental conditions. Furthermore, the integration of digital technologies in agriculture, such as precision farming, is facilitating the targeted application of biostimulants, thereby maximizing their benefits. As these technological advancements continue to evolve, they are expected to propel the growth of the biostimulants market in North America.

Increasing Adoption of Sustainable Agriculture Practices

The North America Biostimulants Market is experiencing a notable shift towards sustainable agriculture practices. Farmers are increasingly recognizing the benefits of biostimulants in enhancing soil health and crop productivity while minimizing chemical inputs. This trend is driven by consumer demand for organic and sustainably produced food, which has seen a growth rate of approximately 10% annually in recent years. As a result, biostimulants are becoming integral to farming strategies aimed at improving environmental sustainability. The adoption of these products is further supported by educational initiatives and outreach programs that inform farmers about the advantages of biostimulants, thereby fostering a more sustainable agricultural landscape in North America.