Global Trends Influencing Local Markets

The italy biostimulants market. As international markets shift towards sustainable practices, Italian farmers are feeling the pressure to adapt to these changes to remain competitive. The global push for reduced chemical usage in agriculture is prompting Italian producers to explore biostimulants as viable alternatives. Furthermore, the export potential of Italian agricultural products is enhanced when biostimulants are utilized, as many international markets favor sustainably produced goods. This global perspective is likely to drive innovation and investment in the biostimulants sector within Italy, as local companies seek to align with international standards and consumer preferences. The interplay between The italy biostimulants market.

Government Policies Favoring Biostimulants

Government policies in Italy are increasingly favoring the use of biostimulants, which serves as a substantial driver for the Italy biostimulants market. The Italian government has implemented various regulations that encourage the development and use of biostimulants as part of its broader agricultural strategy. For instance, the National Plan for Organic Farming emphasizes the importance of biostimulants in promoting sustainable farming practices. Additionally, financial incentives and subsidies for farmers who adopt biostimulant products are becoming more common, which could potentially lead to a surge in market growth. The alignment of these policies with the European Union's Green Deal further strengthens the market's potential, as Italy aims to reduce its carbon footprint and enhance agricultural sustainability.

Increasing Awareness of Sustainable Agriculture

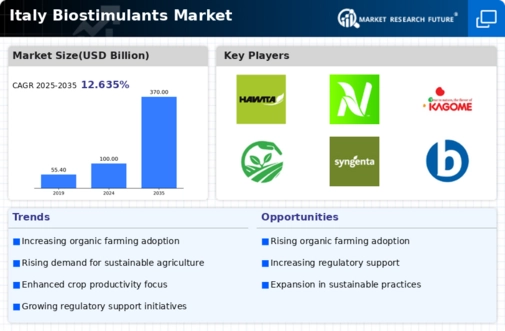

The growing awareness of sustainable agricultural practices among Italian farmers is a key driver for the Italy biostimulants market. As consumers increasingly demand organic and sustainably produced food, farmers are compelled to adopt practices that enhance soil health and crop productivity without relying on synthetic fertilizers. This shift is reflected in the Italian agricultural sector, where biostimulants are recognized for their ability to improve nutrient uptake and resilience against environmental stressors. The Italian Ministry of Agriculture has also promoted initiatives to educate farmers about the benefits of biostimulants, further driving their adoption. Consequently, the market for biostimulants is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years.

Rising Consumer Demand for Eco-Friendly Products

The rising consumer demand for eco-friendly agricultural products is a significant driver for the Italy biostimulants market. As consumers become more conscious of the environmental impact of conventional farming practices, there is a growing preference for products that are produced using sustainable methods. This trend is prompting Italian farmers to seek alternatives to chemical fertilizers, leading to an increased interest in biostimulants. Retailers and food producers are also responding to this demand by sourcing ingredients from farms that utilize biostimulants, thereby creating a market pull for these products. The Italian biostimulants market is expected to benefit from this shift, as more farmers adopt biostimulants to meet consumer expectations and enhance the sustainability of their operations.

Technological Advancements in Biostimulant Formulations

Technological advancements in the formulation of biostimulants are significantly influencing the Italy biostimulants market. Innovations in biotechnology and microbiology have led to the development of more effective and targeted biostimulant products. These advancements allow for the creation of formulations that can enhance plant growth, improve nutrient efficiency, and increase resistance to pests and diseases. Research institutions in Italy are collaborating with industry players to develop cutting-edge biostimulant solutions tailored to local agricultural conditions. This synergy between research and industry is expected to result in a wider range of biostimulant products available in the market, thereby attracting more farmers to adopt these solutions. The market is likely to see a diversification of biostimulant offerings, catering to various crops and farming practices.