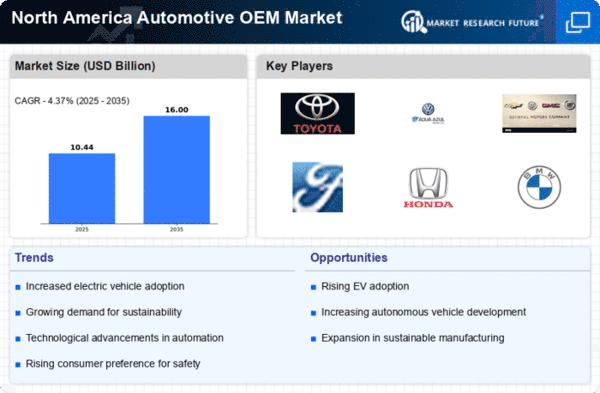

Shift Towards Sustainable Practices

Sustainability is becoming a pivotal driver in the automotive OEM market in North America. As environmental concerns gain prominence, manufacturers are increasingly adopting sustainable practices throughout their supply chains. This includes sourcing materials responsibly, reducing waste, and implementing energy-efficient production methods. Reports suggest that companies embracing sustainability could see a 20% increase in brand loyalty among consumers. Furthermore, the shift towards electric and hybrid vehicles aligns with this trend, as consumers are more inclined to support brands that prioritize eco-friendly initiatives. Consequently, the automotive OEM market is likely to evolve, with sustainability becoming a core component of business strategies.

Growth of E-commerce in Automotive Sales

The automotive OEM market in North America is experiencing a transformation due to the growth of e-commerce in automotive sales. As consumers increasingly prefer online shopping, OEMs are adapting their sales strategies to meet this demand. Recent data indicates that online vehicle sales could account for up to 15% of total sales by 2026. This shift not only streamlines the purchasing process but also allows manufacturers to reach a broader audience. Additionally, the integration of virtual showrooms and online configurators enhances customer engagement, making it easier for consumers to customize their vehicles. As e-commerce continues to reshape the automotive landscape, the OEM market is likely to see significant changes in how vehicles are marketed and sold.

Consumer Demand for Connectivity Features

The automotive OEM market in North America is witnessing a notable shift in consumer preferences towards connectivity features in vehicles. As consumers increasingly seek integrated technology solutions, the demand for infotainment systems, smartphone connectivity, and advanced telematics is on the rise. Recent surveys indicate that approximately 70% of consumers prioritize connectivity options when purchasing a vehicle. This trend is prompting OEMs to enhance their offerings, leading to a competitive landscape where manufacturers must innovate to attract tech-savvy buyers. The integration of these features not only enhances the driving experience but also positions the automotive OEM market to capitalize on the growing trend of smart mobility.

Technological Advancements in Manufacturing

The automotive OEM market in North America is experiencing a surge in technological advancements that enhance manufacturing processes. Automation and robotics are increasingly integrated into production lines, leading to improved efficiency and reduced labor costs. For instance, the adoption of Industry 4.0 technologies is projected to increase productivity by up to 30% in the next few years. Additionally, the implementation of advanced materials, such as lightweight composites, is becoming more prevalent, contributing to fuel efficiency and performance. This shift not only meets regulatory standards but also aligns with consumer demand for more sustainable vehicles. As manufacturers invest in these technologies, the automotive OEM market is likely to see a significant transformation, fostering innovation and competitiveness in the industry.

Regulatory Compliance and Environmental Standards

In North America, the automotive OEM market is heavily influenced by stringent regulatory compliance and environmental standards. The introduction of more rigorous emissions regulations necessitates that manufacturers innovate to meet these requirements. For example, the Corporate Average Fuel Economy (CAFE) standards mandate that automakers achieve an average fuel economy of 54.5 mpg by 2025. This regulatory landscape compels OEMs to invest in cleaner technologies and alternative fuel vehicles, which could account for an estimated 25% of the market share by 2030. Consequently, the pressure to comply with these regulations drives research and development efforts, ultimately shaping the future of the automotive OEM market.