Rising Awareness and Education

There is a growing awareness regarding the importance of effective wound management in North America, which is positively influencing the advanced wound-care market. Educational initiatives aimed at healthcare professionals and patients are increasing understanding of advanced wound-care products and their benefits. This heightened awareness is leading to more informed decision-making in treatment options, thereby driving demand. The advanced wound-care market is witnessing a shift as healthcare providers prioritize education and training, ensuring that both patients and practitioners are equipped with the knowledge necessary for optimal wound care. As awareness continues to rise, the market is expected to expand, reflecting the need for effective wound management solutions.

Aging Population and Healthcare Demand

The demographic shift towards an aging population in North America is significantly impacting the advanced wound-care market. As individuals age, they become more susceptible to wounds and skin-related issues, leading to an increased demand for advanced wound-care products. By 2030, it is estimated that around 20% of the U.S. population will be over 65 years old, which correlates with a higher incidence of chronic wounds. This demographic trend is prompting healthcare providers to invest in advanced wound-care solutions that cater to the needs of older patients. The advanced wound-care market is thus likely to see sustained growth as healthcare systems adapt to the challenges posed by an aging population.

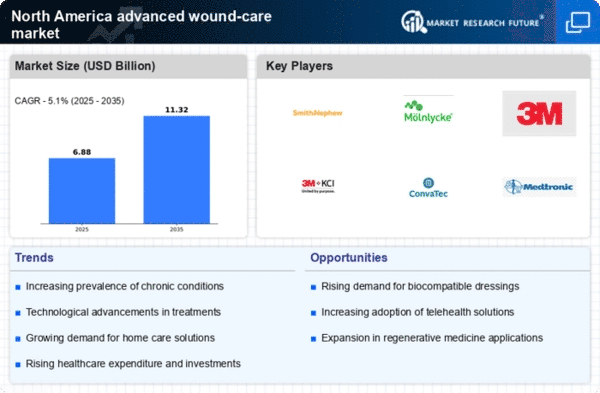

Technological Innovations in Treatment

Technological advancements play a crucial role in shaping the advanced wound-care market in North America. Innovations such as bioengineered skin substitutes, negative pressure wound therapy, and advanced dressings are transforming treatment protocols. The integration of smart technologies, including telemedicine and mobile health applications, enhances patient monitoring and care delivery. The market is projected to reach approximately $10 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 6.5%. These innovations not only improve healing outcomes but also reduce healthcare costs, making them attractive to both providers and patients. The advanced wound-care market is thus positioned to benefit from ongoing research and development efforts aimed at enhancing treatment efficacy.

Increasing Incidence of Chronic Diseases

The advanced wound-care market in North America is experiencing growth due to the rising incidence of chronic diseases such as diabetes and obesity. These conditions often lead to complications like diabetic foot ulcers and pressure sores, necessitating advanced wound-care solutions. According to recent data, approximately 30.3 million people in the U.S. have diabetes, which significantly increases the demand for specialized wound care. The advanced wound-care market is adapting to this trend by developing innovative products that cater to the unique needs of patients with chronic conditions. As the population ages and the prevalence of chronic diseases continues to rise, the market is likely to expand further, driven by the need for effective wound management solutions.

Healthcare Policy and Reimbursement Changes

Changes in healthcare policies and reimbursement frameworks are significantly impacting the advanced wound-care market in North America. Recent reforms have aimed to improve access to advanced wound-care treatments, making them more affordable for patients. Insurance coverage for advanced wound-care products is expanding, which is likely to enhance market penetration. The advanced wound-care market is adapting to these changes by aligning product offerings with reimbursement guidelines, ensuring that healthcare providers can offer the best care without financial constraints. As policies continue to evolve, the market is expected to grow, driven by increased accessibility and affordability of advanced wound-care solutions.