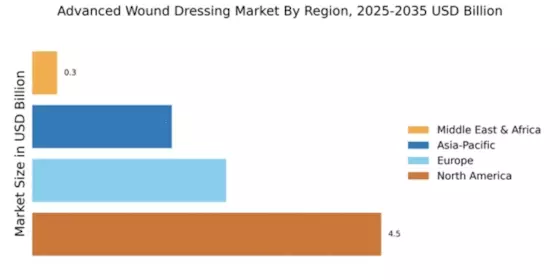

North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Advanced Wound Dressing Market, holding a significant market share of 4.5 in 2024. The region's growth is driven by increasing incidences of chronic wounds, a rising geriatric population, and advancements in wound care technologies. Regulatory support from agencies like the FDA further catalyzes innovation and market expansion, ensuring that new products meet stringent safety and efficacy standards. The competitive landscape in North America is robust, featuring key players such as Smith & Nephew, 3M, and Acelity. These companies are at the forefront of developing innovative wound care solutions, leveraging advanced materials and technologies. The presence of established healthcare infrastructure and a focus on patient-centered care further enhance market dynamics, making North America a critical hub for advanced wound dressing solutions.

Europe : Emerging Market with Growth Potential

Europe, with a market size of 2.5, is witnessing significant growth in the Advanced Wound Dressing Market. Factors such as an increasing prevalence of diabetes and vascular diseases, along with a growing emphasis on advanced healthcare solutions, are driving demand. Regulatory frameworks across the EU are evolving to support innovative wound care products, ensuring compliance with safety standards and promoting market entry for new technologies. Leading countries in this region include Germany, the UK, and France, where major players like Mölnlycke Health Care and B. Braun Melsungen AG are actively expanding their product portfolios. The competitive landscape is characterized by strategic partnerships and collaborations aimed at enhancing product offerings. The European market is expected to continue its upward trajectory, supported by ongoing research and development initiatives in wound care.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific region, with a market size of 1.8, is emerging as a significant player in the Advanced Wound Dressing Market. The growth is fueled by rising healthcare awareness, increasing disposable incomes, and a growing elderly population. Additionally, government initiatives aimed at improving healthcare infrastructure are creating a favorable environment for market expansion. Regulatory bodies are also focusing on enhancing the quality of wound care products, which is expected to drive innovation in the sector. Countries like Japan, China, and India are leading the charge, with key players such as Medtronic and ConvaTec establishing a strong presence. The competitive landscape is marked by a mix of local and international companies, all vying for market share. As the region continues to develop, the demand for advanced wound care solutions is anticipated to rise, driven by both clinical needs and consumer awareness.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region, with a market size of 0.32, is gradually emerging in the Advanced Wound Dressing Market. The growth is primarily driven by increasing healthcare investments and a rising prevalence of chronic wounds. However, challenges such as limited access to advanced healthcare facilities and varying regulatory standards across countries can hinder market growth. Efforts to improve healthcare infrastructure are underway, which may enhance the market landscape in the coming years. Leading countries in this region include South Africa and the UAE, where companies like Hollister Incorporated and Coloplast are making strides in expanding their product offerings. The competitive landscape is evolving, with both local and international players seeking to establish a foothold. As awareness of advanced wound care solutions increases, the market is expected to grow, albeit at a slower pace compared to other regions.