Increased Use in Industrial Applications

The 3d imaging market is witnessing increased utilization in industrial applications, particularly in sectors such as aerospace, automotive, and construction. Companies are adopting 3d imaging technologies to enhance quality control, streamline production processes, and improve safety measures. For instance, 3d imaging is employed in the inspection of components to ensure they meet stringent quality standards, thereby reducing the risk of defects. This trend is expected to drive market growth, as industries seek to optimize their operations and reduce costs. The industrial segment is projected to account for a significant share of the market, with estimates suggesting it could represent around 40% of total revenue by 2026, underscoring the importance of 3d imaging in modern manufacturing.

Surge in Demand for Enhanced Visualization

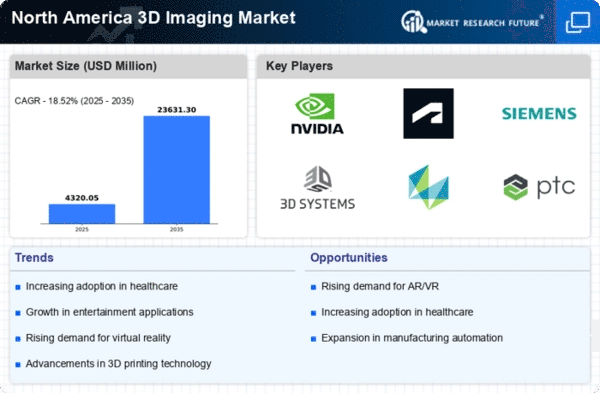

The 3d imaging market is experiencing a notable surge in demand for enhanced visualization across various sectors, particularly in healthcare and manufacturing. This demand is driven by the need for precise imaging solutions that facilitate better decision-making and improve operational efficiency. In healthcare, for instance, the use of 3d imaging technologies has been linked to improved patient outcomes, as they allow for more accurate diagnostics and treatment planning. The market is projected to grow at a CAGR of approximately 15% over the next five years, indicating a robust expansion fueled by technological advancements and increasing applications in diverse fields. As industries recognize the value of 3d imaging, investments are likely to increase, further propelling the market forward.

Growing Investment in Research and Development

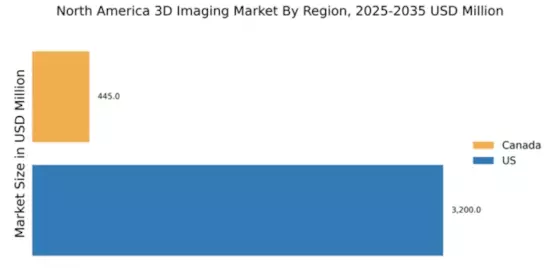

Investment in research and development (R&D) within the 3d imaging market is on the rise, as companies strive to innovate and enhance their product offerings. This trend is particularly evident in North America, where significant funding is allocated to developing advanced imaging technologies. The focus on R&D is expected to yield breakthroughs in imaging resolution, speed, and integration with other technologies, such as artificial intelligence and machine learning. As a result, the market could witness a substantial increase in the introduction of new products and services, catering to a wider range of applications. The anticipated growth in R&D spending is likely to contribute to a projected market value of over $10 billion by 2027, reflecting the industry's commitment to innovation.

Rising Demand for Virtual and Augmented Reality

The integration of 3d imaging technologies with virtual and augmented reality (VR/AR) applications is becoming increasingly prevalent in the 3d imaging market. This convergence is driven by the growing demand for immersive experiences in sectors such as gaming, education, and training. As organizations seek to enhance user engagement and learning outcomes, the adoption of 3d imaging in VR/AR applications is likely to expand. The market for VR/AR is projected to grow significantly, with estimates indicating a potential value of $300 billion by 2025. This growth presents a substantial opportunity for the 3d imaging market, as companies develop solutions that cater to the evolving needs of consumers and businesses alike.

Expansion of 3d Imaging in Education and Training

The 3d imaging market is experiencing an expansion in educational and training applications, as institutions recognize the benefits of immersive learning experiences. 3d imaging technologies are being utilized to create interactive simulations and visualizations that enhance understanding and retention of complex concepts. This trend is particularly relevant in fields such as medicine, engineering, and architecture, where spatial awareness and visualization skills are crucial. The education sector is projected to invest heavily in 3d imaging solutions, with estimates suggesting a growth rate of around 20% annually over the next few years. As educational institutions increasingly adopt these technologies, the 3d imaging market is likely to see a corresponding rise in demand.