Expansion of Biopharmaceutical Sector

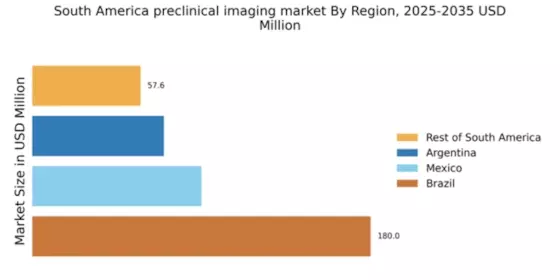

The biopharmaceutical sector in South America is expanding rapidly, which is positively impacting the preclinical imaging market. With an increasing number of biopharmaceutical companies emerging in countries like Brazil and Argentina, there is a heightened need for advanced imaging technologies to support drug development processes. The preclinical imaging market is expected to benefit from this growth, as these companies require sophisticated imaging solutions to assess drug efficacy and safety. Market data indicates that the biopharmaceutical market in South America could reach approximately $30 billion by 2026, further driving demand for preclinical imaging technologies that facilitate research and development.

Rising Focus on Personalized Medicine

The preclinical imaging market in South America is witnessing a rising focus on personalized medicine, which is reshaping research and development strategies. As healthcare systems increasingly emphasize tailored treatment approaches, the demand for imaging technologies that can provide detailed insights into individual biological responses is growing. This trend is likely to drive the adoption of advanced imaging modalities that facilitate the study of disease mechanisms and treatment responses at a personalized level. Market analysts suggest that the personalized medicine sector could account for over 30% of the overall healthcare market in South America by 2027, thereby enhancing the relevance and application of preclinical imaging technologies.

Growing Demand for Non-Invasive Techniques

The preclinical imaging market in South America is experiencing a notable increase in demand for non-invasive imaging techniques. Researchers and pharmaceutical companies are increasingly recognizing the benefits of these methods, which allow for real-time monitoring of biological processes without the need for invasive procedures. This shift is likely driven by the need for more ethical research practices and the desire to reduce animal suffering. As a result, the market for modalities such as MRI, PET, and CT is projected to grow significantly, with estimates suggesting a CAGR of around 8% over the next few years. This trend indicates a robust future for the preclinical imaging market in South America, as stakeholders prioritize humane research methodologies.

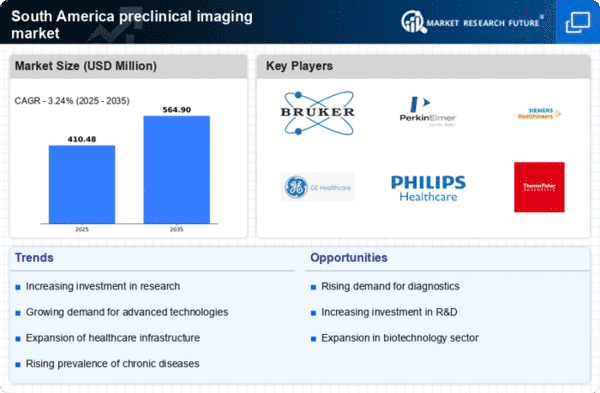

Increased Funding for Research Initiatives

In South America, there is an increase in funding for research initiatives, which is positively impacting the preclinical imaging market. Government and private sector investments are being directed towards enhancing research capabilities in life sciences, including preclinical studies. This influx of funding is likely to support the acquisition of advanced imaging technologies and the establishment of state-of-the-art research facilities. As a result, the preclinical imaging market is expected to experience growth, with projections indicating a potential increase in market size by 15% over the next five years. This financial support is crucial for fostering innovation and improving research outcomes in the region.

Collaborations Between Academia and Industry

Collaborations between academic institutions and industry players are becoming more prevalent in South America, significantly influencing the preclinical imaging market. These partnerships often focus on advancing research capabilities and developing innovative imaging technologies. By pooling resources and expertise, academic institutions can enhance their research output, while industry partners gain access to cutting-edge research findings. This synergy is likely to foster the development of novel imaging modalities tailored to specific research needs. As a result, the preclinical imaging market is expected to see increased investment and innovation, potentially leading to breakthroughs in imaging techniques that could revolutionize preclinical studies.