North America : Stable Market with Growth Potential

The North American rigid plastic packaging market is projected to grow steadily, driven by increasing demand for sustainable packaging solutions and innovations in material technology. With a market size of $10.0 billion, the region is focusing on regulatory compliance and environmental sustainability, which are key growth drivers. The shift towards eco-friendly packaging is expected to enhance market dynamics further, as consumers increasingly prefer sustainable options.

Leading countries in this region include the US and Canada, where major players like Berry Global and Sealed Air are actively innovating. The competitive landscape is characterized by a mix of established companies and emerging startups, all vying for market share. The presence of key players ensures a robust supply chain and a variety of product offerings, catering to diverse consumer needs. The market is also witnessing strategic partnerships aimed at enhancing product portfolios and expanding market reach.

Europe : Leading Market with Innovation Focus

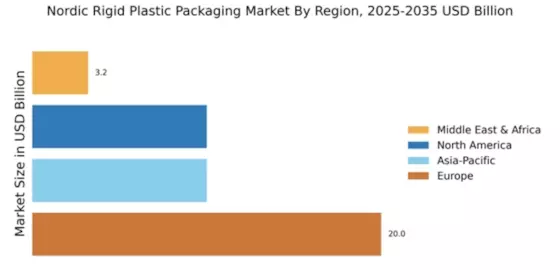

Europe holds the largest market share in the Nordic rigid plastic packaging sector, valued at $20.0 billion. The region's growth is fueled by stringent regulations promoting sustainability and innovation in packaging materials. The European market is characterized by a strong emphasis on recycling and reducing plastic waste, aligning with EU directives aimed at achieving circular economy goals. This regulatory environment is a significant catalyst for market expansion, driving demand for advanced packaging solutions.

Countries like Germany, France, and the UK are at the forefront of this market, with key players such as Tetra Pak and Amcor leading the charge. The competitive landscape is robust, with numerous companies investing in R&D to develop innovative products that meet consumer demands for sustainability. The presence of established firms and a growing number of startups contribute to a dynamic market environment, fostering continuous improvement and adaptation to market trends.

Asia-Pacific : Emerging Market with Growth Opportunities

The Asia-Pacific rigid plastic packaging market is valued at $10.0 billion and is witnessing rapid growth due to increasing urbanization and rising disposable incomes. The demand for packaged food and beverages is on the rise, driven by changing consumer lifestyles and preferences. Regulatory support for sustainable packaging solutions is also a significant growth driver, as governments in the region push for eco-friendly practices to combat plastic pollution.

Leading countries in this market include China, Japan, and India, where major players like SABIC and Plastipak are making significant inroads. The competitive landscape is evolving, with both multinational corporations and local companies vying for market share. The presence of key players ensures a diverse range of products, catering to various sectors, including food, pharmaceuticals, and consumer goods, thus enhancing market dynamics.

Middle East and Africa : Developing Market with Potential

The Middle East and Africa rigid plastic packaging market is valued at $3.2 billion, with significant growth potential driven by increasing demand for packaged goods and a shift towards modern retail formats. The region is experiencing a rise in consumer awareness regarding sustainable packaging, prompting manufacturers to innovate and adapt to changing market needs. Regulatory frameworks are gradually evolving to support sustainable practices, which is expected to further boost market growth.

Countries like South Africa and the UAE are leading the market, with key players such as Greiner Packaging and Alpla establishing a strong presence. The competitive landscape is characterized by a mix of local and international companies, all striving to capture market share. The growing emphasis on sustainability and innovation is likely to shape the future of the rigid plastic packaging market in this region, creating new opportunities for growth and development.