Growth in Emerging Markets

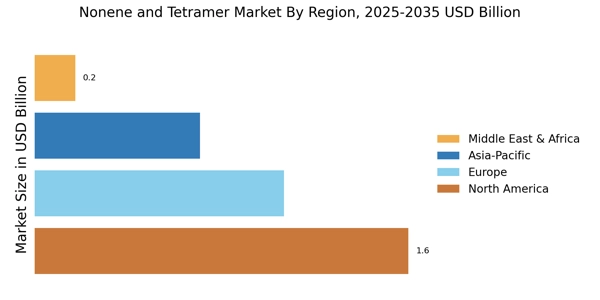

Emerging markets are playing a crucial role in the growth of the Nonene and Tetramer Market. Rapid industrialization and urbanization in regions such as Asia-Pacific and Latin America are driving the demand for nonene-based products. The increasing population and rising disposable incomes in these regions are contributing to higher consumption of petrochemical products. In 2025, it is projected that the Asia-Pacific region will account for over 40% of the global nonene consumption, highlighting its importance as a key market. This trend indicates that the Nonene and Tetramer Market is likely to experience robust growth opportunities as manufacturers seek to capitalize on the expanding consumer base in these emerging economies.

Rising Demand for Petrochemicals

The Nonene and Tetramer Market is experiencing a notable increase in demand for petrochemicals, driven by their extensive applications in various sectors. The growth in the automotive and construction industries has led to a surge in the need for high-performance materials, which utilize nonene and its derivatives. In 2025, the demand for petrochemical products is projected to reach approximately 1.5 billion metric tons, indicating a robust market environment. This trend suggests that the Nonene and Tetramer Market will likely benefit from the expanding petrochemical sector, as manufacturers seek to enhance product performance and sustainability. Furthermore, the increasing focus on lightweight materials in automotive manufacturing is expected to further propel the demand for nonene-based products, thereby solidifying the market's growth trajectory.

Innovations in Chemical Processing

Innovations in chemical processing technologies are significantly influencing the Nonene and Tetramer Market. Advanced catalytic processes and improved separation techniques are enhancing the efficiency of nonene production, leading to higher yields and reduced operational costs. For instance, the introduction of more efficient catalysts has the potential to increase production rates by up to 30%, thereby making nonene more accessible to manufacturers. This technological evolution not only supports the economic viability of nonene production but also aligns with the industry's sustainability goals. As companies invest in research and development, the Nonene and Tetramer Market is likely to witness a wave of new products and applications, further diversifying its market offerings and enhancing competitiveness.

Expanding Applications in Consumer Goods

The Nonene and Tetramer Market is witnessing an expansion in applications within the consumer goods sector. Nonene derivatives are increasingly being utilized in the formulation of personal care products, detergents, and packaging materials. The versatility of nonene allows for the development of high-performance products that meet consumer demands for quality and sustainability. In 2025, the personal care segment is expected to account for a significant share of the nonene market, driven by the rising consumer preference for premium products. This trend suggests that the Nonene and Tetramer Market will continue to diversify its application base, thereby enhancing its market potential and attracting new investments.

Regulatory Support for Sustainable Practices

The Nonene and Tetramer Market is benefiting from increasing regulatory support aimed at promoting sustainable practices. Governments are implementing stricter environmental regulations that encourage the use of eco-friendly materials and processes. This regulatory landscape is pushing manufacturers to adopt sustainable practices, such as utilizing renewable feedstocks for nonene production. In 2025, it is anticipated that the market for bio-based chemicals, including nonene, will grow at a compound annual growth rate of 8%, reflecting a shift towards sustainability. This trend indicates that the Nonene and Tetramer Market is likely to evolve in response to regulatory pressures, fostering innovation and the development of greener alternatives.