Rising Demand for Eco-Friendly Solutions

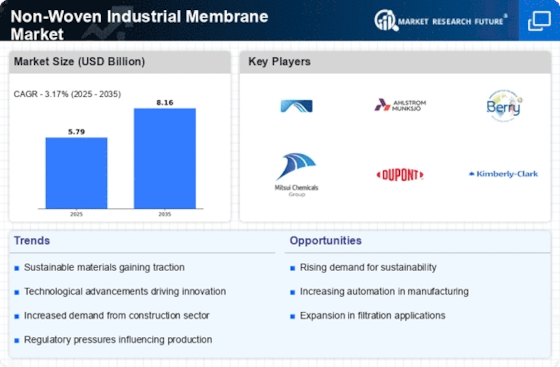

The Non-Woven Industrial Membrane Market is experiencing a notable surge in demand for eco-friendly solutions. As industries increasingly prioritize sustainability, non-woven membranes, which are often made from recyclable materials, are becoming a preferred choice. This shift is driven by regulatory pressures and consumer preferences for environmentally responsible products. In 2025, the market is projected to grow at a compound annual growth rate of approximately 6.5%, reflecting the increasing adoption of sustainable practices across various sectors. Companies are investing in research and development to enhance the biodegradability and recyclability of these membranes, further propelling their market presence. The emphasis on reducing carbon footprints and waste is likely to continue influencing purchasing decisions, thereby solidifying the role of non-woven membranes in industrial applications.

Regulatory Support for Advanced Materials

Regulatory frameworks are increasingly favoring the adoption of advanced materials, including those found in the Non-Woven Industrial Membrane Market. Governments are implementing policies that encourage the use of high-performance materials that meet stringent environmental and safety standards. This regulatory support is likely to stimulate investment in the development of non-woven membranes that comply with these guidelines. As industries strive to meet regulatory requirements, the demand for compliant non-woven membranes is expected to rise. Furthermore, initiatives aimed at promoting sustainable manufacturing practices are likely to create a favorable environment for the growth of this market. The alignment of industry standards with regulatory expectations may enhance the credibility and acceptance of non-woven membranes in various applications.

Increased Focus on Health and Safety Standards

The Non-Woven Industrial Membrane Market is experiencing heightened attention towards health and safety standards, particularly in sectors such as healthcare and food processing. The ongoing emphasis on hygiene and safety protocols is driving the demand for non-woven membranes that provide effective barriers against contaminants. In healthcare, the use of non-woven materials in surgical gowns and masks is becoming increasingly prevalent, as they offer superior protection and comfort. Similarly, in food processing, non-woven membranes are utilized to ensure product safety and extend shelf life. This focus on health and safety is likely to propel market growth, as industries seek to enhance their compliance with stringent regulations. The increasing awareness of health risks associated with inadequate protective measures is expected to further drive the adoption of non-woven membranes.

Expanding Applications Across Various Industries

The Non-Woven Industrial Membrane Market is witnessing an expansion in applications across multiple sectors, including construction, automotive, and healthcare. In construction, non-woven membranes are increasingly utilized for moisture control and air filtration, enhancing building performance and energy efficiency. The automotive sector is adopting these membranes for lightweight components, contributing to fuel efficiency and reduced emissions. In healthcare, the demand for sterile and protective barriers is driving the use of non-woven membranes in medical devices and personal protective equipment. This diversification of applications is likely to bolster market growth, as industries recognize the versatility and performance benefits of non-woven membranes. The increasing focus on innovation and product development in these sectors is expected to further enhance the market's trajectory.

Technological Innovations in Manufacturing Processes

Technological advancements are playing a pivotal role in shaping the Non-Woven Industrial Membrane Market. Innovations in manufacturing processes, such as spunbond and meltblown technologies, are enhancing the efficiency and quality of non-woven membranes. These technologies allow for the production of membranes with superior filtration capabilities and durability, catering to diverse industrial applications. The market is witnessing an influx of smart membranes that incorporate sensors and other functionalities, which could potentially revolutionize their use in various sectors. As manufacturers adopt these advanced technologies, the overall production costs may decrease, making non-woven membranes more accessible to a broader range of industries. This trend is expected to drive market growth, as companies seek to leverage these innovations to improve their operational efficiencies.