Expansion of Telemedicine

The expansion of telemedicine is reshaping the Non Mydriatic Fundus Camera Market by facilitating remote patient monitoring and consultations. As healthcare systems increasingly adopt telehealth solutions, the demand for portable and user-friendly imaging devices is on the rise. Non mydriatic fundus cameras are particularly well-suited for telemedicine applications, as they allow for quick and efficient retinal imaging without the need for pupil dilation. This capability is essential for remote assessments, especially in underserved areas where access to eye care specialists may be limited. Market analysts project that the telemedicine sector will continue to grow, potentially reaching a valuation of over 250 billion dollars by 2027. This growth is likely to drive further adoption of non-mydriatic imaging technologies, as healthcare providers seek to enhance their telehealth offerings.

Growing Awareness of Eye Health

There is a notable increase in public awareness regarding eye health, which is significantly influencing the Non Mydriatic Fundus Camera Market. Educational campaigns and initiatives by health organizations are emphasizing the importance of regular eye examinations, particularly for individuals at risk of retinal diseases. This heightened awareness is likely to drive demand for non-mydriatic imaging solutions, as they offer a more comfortable and efficient alternative to traditional methods. According to recent surveys, nearly 60% of adults now recognize the importance of eye health, which correlates with an increase in eye care visits. Consequently, healthcare providers are investing in advanced imaging technologies to meet this growing demand, further propelling the market forward. The trend suggests that as more individuals prioritize their eye health, the Non Mydriatic Fundus Camera Market will play a pivotal role in routine eye care.

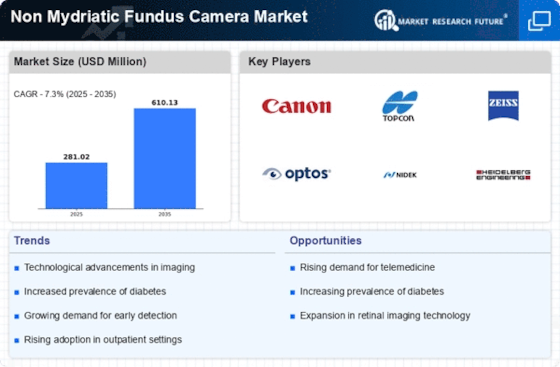

Technological Advancements in Imaging

The Non Mydriatic Fundus Camera Market is experiencing a surge in technological advancements that enhance imaging quality and diagnostic capabilities. Innovations such as high-resolution imaging sensors and advanced software algorithms are improving the accuracy of retinal examinations. These developments are likely to facilitate early detection of ocular diseases, which is crucial for effective treatment. The market is projected to grow at a compound annual growth rate of approximately 7% over the next few years, driven by these technological improvements. Furthermore, the integration of artificial intelligence in image analysis is expected to streamline workflows in clinical settings, making the Non Mydriatic Fundus Camera Market more appealing to healthcare providers. As a result, the demand for these devices is anticipated to increase, reflecting a broader trend towards precision medicine in ophthalmology.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are emerging as significant factors influencing the Non Mydriatic Fundus Camera Market. Governments and health authorities are increasingly recognizing the importance of early detection and management of eye diseases, leading to the establishment of supportive regulatory frameworks. These frameworks often include streamlined approval processes for new imaging technologies, which can accelerate market entry for innovative non-mydriatic fundus cameras. Additionally, reimbursement policies that cover the costs of these devices are likely to encourage healthcare providers to adopt them more widely. As reimbursement rates improve, the financial burden on patients decreases, making eye care more accessible. This trend suggests that as regulatory environments become more favorable, the market for non-mydriatic fundus cameras will likely experience robust growth.

Aging Population and Increased Incidence of Eye Diseases

The aging population is a critical driver of the Non Mydriatic Fundus Camera Market, as older adults are more susceptible to various eye diseases, including diabetic retinopathy and age-related macular degeneration. As the global population ages, the prevalence of these conditions is expected to rise, leading to an increased demand for effective diagnostic tools. The World Health Organization has reported that the number of individuals aged 60 and older is projected to double by 2050, which will likely result in a corresponding increase in eye care needs. Consequently, healthcare providers are investing in non-mydriatic fundus cameras to enhance their diagnostic capabilities and manage the growing patient population. This trend indicates that the market for these devices will continue to expand as healthcare systems adapt to the challenges posed by an aging demographic.