Research Methodology on Non-Destructive Testing Services Market

Introduction

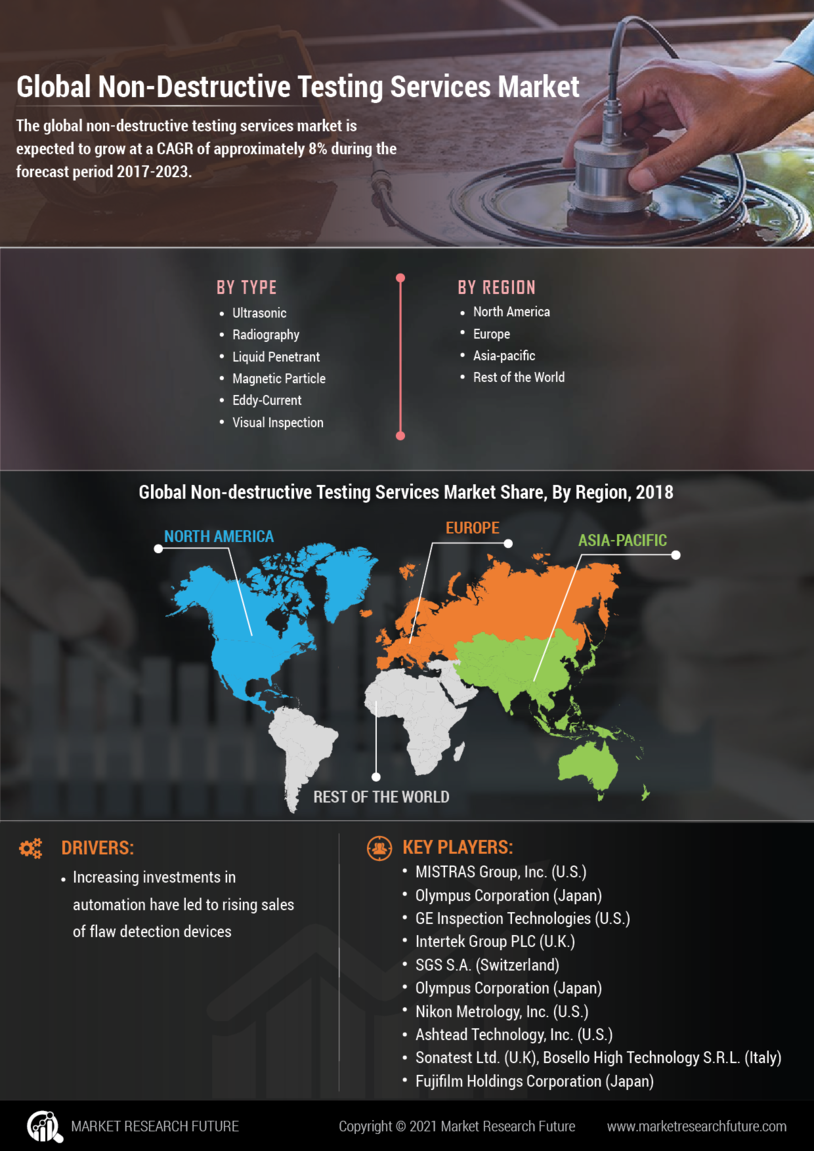

Non-destructive testing (NDT) refers to a suite of techniques used to evaluate the properties of a material, component or system without damaging or destroying it. There has been an increasing demand for services related to non-destructive testing (NDT) in recent years. This research aims at providing a comprehensive overview of the Non-Destructive Testing Services market and its growth over the forecast period 2023 to 2030. The research report incorporates insights gathered from extensive primary and secondary research and is supported by numerical data and graphical representation.

Research Methodology

Research goals and scope

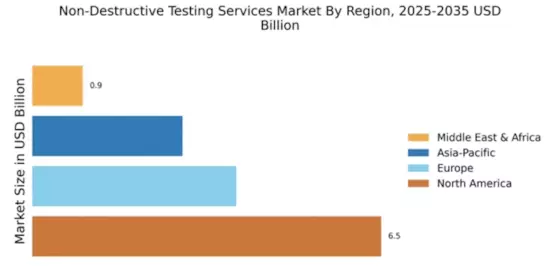

The goal of this research is to provide a comprehensive understanding of the Non-Destructive Testing Services (NDS) market and its size and growth over the forecast period. The scope of the research includes an in-depth study of the market dynamics including drivers, restraints, opportunities and challenges, segmentation, competition and regional analysis.

Data sources

The primary data sources for this research include surveys and interviews with industry players, such as manufacturers, distributors and suppliers. Secondary data sources include industry publications, government publications, and other online sources such as journals and databases. The information sources include both paid and free sources.

Research approach

The research approach used is qualitative. The research is conducted with the help of primary and secondary sources as well as an analysis of market structure. The research is conducted by interviewing industry experts and conducting surveys and industry reports.

Sample size and sampling methodology

The sample size is chosen based on the size of the population and the methodology used to choose the sample is the stratified random sampling method. The sample is chosen based on the purpose of the research and the population of the study.

Data collection

The data is collected from primary and secondary sources, which include interviews with industry professionals, surveys from key stakeholders and industry reports. The data is collected from sources such as Porter’s Five Forces Analysis, SWOT Analysis, and statistical reports.

Data analysis

The data obtained from the sources are analysed using statistical methods. The data is analysed for key trends, market size and growth, segmentation, and competitive analysis using qualitative and quantitative methods.

Conclusion

This research provides a comprehensive overview of the Non-Destructive Testing Services (NDS) market and its growth prospects. The research includes a comprehensive primary and secondary data collection, with an analysis of market structure, dynamics and key trends. The research is conducted using a qualitative approach and data analysis is done using statistical and qualitative methods.