Rising Demand for Steel Production

The increasing demand for steel production is a primary driver of the Noble Ferroalloy Market. As economies expand, the need for infrastructure development and construction projects rises, leading to a surge in steel consumption. Noble ferroalloys, such as ferrochromium and ferromanganese, are essential in steelmaking processes, enhancing the strength and durability of steel products. In 2025, the steel production is projected to reach approximately 1.9 billion metric tons, indicating a robust growth trajectory. This heightened demand for steel directly correlates with the need for noble ferroalloys, thereby propelling the market forward. The Noble Ferroalloy Market is likely to experience significant growth as manufacturers strive to meet the escalating requirements of the steel sector.

Technological Innovations in Production

Technological advancements in the production of noble ferroalloys are significantly influencing the Noble Ferroalloy Market. Innovations such as improved smelting techniques and energy-efficient processes are enhancing production efficiency and reducing costs. For instance, the adoption of electric arc furnaces has revolutionized the way ferroalloys are produced, allowing for better control over the quality and composition of the final product. As of 2025, it is estimated that these technological improvements could lead to a 15% reduction in production costs, making noble ferroalloys more accessible to manufacturers. This trend not only boosts the competitiveness of the Noble Ferroalloy Market but also encourages further investments in research and development, fostering a cycle of continuous improvement.

Environmental Regulations and Compliance

The increasing stringency of environmental regulations is a crucial driver for the Noble Ferroalloy Market. Governments worldwide are implementing stricter policies aimed at reducing carbon emissions and promoting sustainable practices in industrial operations. As a result, manufacturers are compelled to adopt cleaner production methods and invest in technologies that minimize environmental impact. The noble ferroalloy sector is particularly affected, as the production processes are energy-intensive and can generate significant emissions. In 2025, compliance with these regulations is expected to drive a shift towards more sustainable practices, potentially increasing the market share of eco-friendly noble ferroalloys. This shift not only aligns with The Noble Ferroalloy Industry favorably in a competitive landscape increasingly focused on environmental responsibility.

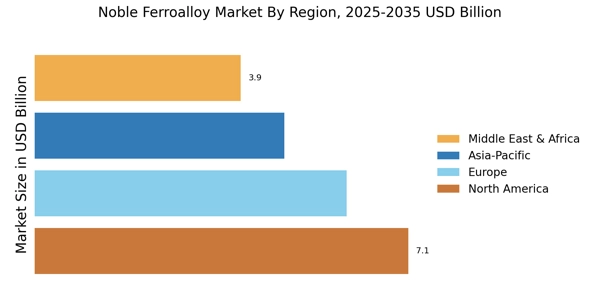

Emerging Markets and Economic Development

Emerging markets are playing a pivotal role in shaping the Noble Ferroalloy Market. As countries in Asia, Africa, and South America experience rapid economic development, the demand for infrastructure and industrialization is surging. This growth is accompanied by an increased need for steel and, consequently, noble ferroalloys. In 2025, it is anticipated that emerging economies will account for over 60% of the global steel consumption, driving the demand for noble ferroalloys. The expansion of these markets presents lucrative opportunities for manufacturers and suppliers within the Noble Ferroalloy Market. As investments in infrastructure projects rise, the market is likely to witness a robust increase in demand, further solidifying the importance of noble ferroalloys in supporting economic growth.

Growth in Automotive and Aerospace Industries

The expansion of the automotive and aerospace industries is a significant driver for the Noble Ferroalloy Market. As these sectors evolve, there is a growing demand for high-performance materials that can withstand extreme conditions. Noble ferroalloys, known for their superior properties, are increasingly utilized in manufacturing components for vehicles and aircraft. In 2025, the automotive industry is projected to grow at a compound annual growth rate of 4.5%, while the aerospace sector is expected to expand by 5.2%. This growth translates into a heightened demand for noble ferroalloys, as manufacturers seek materials that enhance safety, efficiency, and performance. Consequently, the Noble Ferroalloy Market is poised to benefit from these trends, as it supplies essential materials to these burgeoning sectors.