Government Incentives and Policies

Government incentives and policies are playing a pivotal role in shaping the Next Generation Advanced Battery Market. Many governments are implementing subsidies and tax incentives to promote the adoption of advanced battery technologies, particularly in the electric vehicle and renewable energy sectors. In 2025, various countries are expected to allocate substantial funding for battery research and development initiatives, fostering innovation and reducing production costs. This supportive regulatory environment is likely to accelerate the deployment of advanced batteries, enhancing their competitiveness in the market. As a result, the Next Generation Advanced Battery Market is poised for robust growth, driven by favorable policy frameworks.

Rising Demand for Electric Vehicles

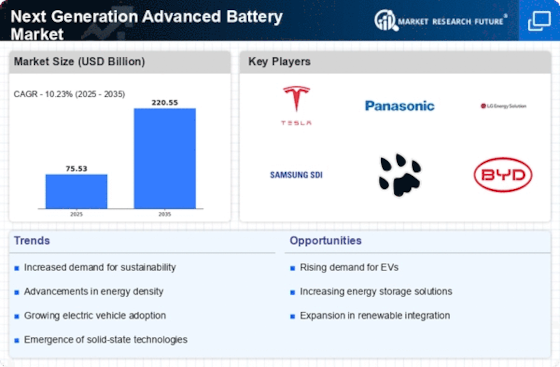

The increasing adoption of electric vehicles (EVs) is a primary driver for the Next Generation Advanced Battery Market. As consumers and manufacturers alike prioritize sustainability, the demand for high-performance batteries that can support longer ranges and faster charging times has surged. In 2025, the EV market is projected to grow at a compound annual growth rate (CAGR) of approximately 20%, necessitating advancements in battery technology. This growth is likely to stimulate investments in research and development, leading to innovations in battery chemistry and design. Consequently, the Next Generation Advanced Battery Market is expected to expand significantly, as manufacturers strive to meet the evolving needs of the automotive sector.

Integration of Renewable Energy Sources

The integration of renewable energy sources into the power grid is increasingly influencing the Next Generation Advanced Battery Market. As countries aim to reduce carbon emissions, the need for efficient energy storage solutions becomes paramount. Advanced batteries are essential for storing energy generated from solar and wind sources, which are inherently intermittent. In 2025, the energy storage market is anticipated to reach a valuation of over 200 billion USD, with a substantial portion attributed to advanced battery technologies. This trend suggests that the Next Generation Advanced Battery Market will play a crucial role in facilitating the transition to a more sustainable energy landscape, enabling better management of energy supply and demand.

Technological Advancements in Battery Chemistry

Technological advancements in battery chemistry are driving innovation within the Next Generation Advanced Battery Market. Research into solid-state batteries, lithium-sulfur, and other next-generation chemistries is gaining momentum, promising higher energy densities and improved safety profiles. For instance, solid-state batteries are projected to offer energy densities exceeding 300 Wh/kg, significantly enhancing the performance of electric vehicles and portable electronics. As these technologies mature, they are likely to capture a larger market share, thereby propelling the Next Generation Advanced Battery Market forward. The ongoing exploration of novel materials and manufacturing processes indicates a vibrant future for battery technology.

Growing Consumer Awareness and Demand for Sustainability

Growing consumer awareness regarding environmental issues is significantly influencing the Next Generation Advanced Battery Market. As individuals become more conscious of their carbon footprints, there is an increasing demand for sustainable products, including advanced batteries. This shift in consumer behavior is prompting manufacturers to prioritize eco-friendly materials and production processes. In 2025, it is estimated that over 60% of consumers will consider sustainability as a key factor in their purchasing decisions. This trend suggests that the Next Generation Advanced Battery Market will need to adapt to meet these evolving consumer preferences, potentially leading to innovations in battery recycling and lifecycle management.