Technological Innovations in Device Design

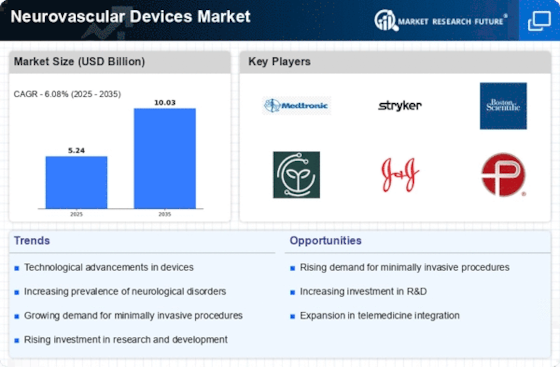

Technological advancements in the design and functionality of neurovascular devices are significantly influencing the Neurovascular Devices Market. Innovations such as advanced imaging techniques, robotic-assisted surgeries, and smart devices enhance the precision and efficacy of neurovascular interventions. For instance, the development of stent retrievers and flow diverters has revolutionized the treatment of complex aneurysms and occlusions. These innovations not only improve patient outcomes but also reduce recovery times, making them attractive options for healthcare providers. As technology continues to evolve, the Neurovascular Devices Market is poised for further expansion, driven by the demand for cutting-edge solutions that enhance procedural success rates.

Rising Incidence of Neurovascular Disorders

The increasing prevalence of neurovascular disorders, such as stroke and aneurysms, is a primary driver of the Neurovascular Devices Market. According to recent data, stroke remains one of the leading causes of death and disability worldwide, with millions affected annually. This rising incidence necessitates advanced treatment options, thereby propelling demand for neurovascular devices. As healthcare systems strive to improve patient outcomes, the focus on innovative solutions to manage these conditions intensifies. The Neurovascular Devices Market is likely to experience substantial growth as healthcare providers seek effective interventions to address the growing patient population suffering from neurovascular diseases.

Aging Population and Associated Health Risks

The aging population is a critical factor contributing to the growth of the Neurovascular Devices Market. As individuals age, the risk of developing neurovascular conditions, such as strokes and vascular malformations, increases significantly. This demographic shift is prompting healthcare systems to prioritize the development and availability of neurovascular devices. Data indicates that the elderly population is projected to grow substantially in the coming years, leading to a higher demand for effective treatment solutions. The Neurovascular Devices Market is expected to expand as healthcare providers seek to address the unique needs of this aging demographic, ensuring timely and effective interventions.

Growing Investment in Healthcare Infrastructure

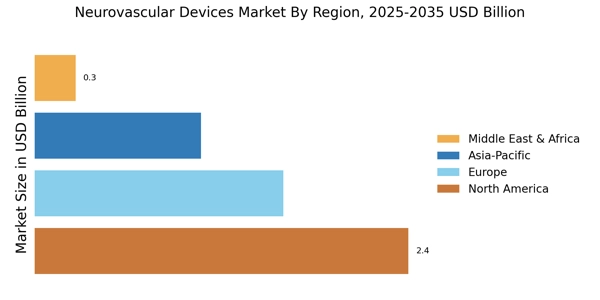

The increasing investment in healthcare infrastructure, particularly in developing regions, is a significant driver of the Neurovascular Devices Market. Governments and private entities are allocating substantial resources to enhance healthcare facilities and improve access to advanced medical technologies. This trend is particularly evident in regions where the burden of neurovascular diseases is high. Enhanced healthcare infrastructure facilitates the adoption of neurovascular devices, as hospitals and clinics are better equipped to provide specialized care. Consequently, the Neurovascular Devices Market is likely to benefit from this influx of investment, leading to improved patient access to innovative treatment options.

Increased Awareness and Education on Neurovascular Health

There is a growing awareness and education regarding neurovascular health, which is positively impacting the Neurovascular Devices Market. Public health campaigns and educational initiatives are informing individuals about the risks associated with neurovascular disorders and the importance of early intervention. This heightened awareness is likely to lead to increased screening and diagnosis rates, subsequently driving demand for neurovascular devices. As patients become more informed about their health options, healthcare providers are compelled to offer advanced treatment solutions. The Neurovascular Devices Market stands to benefit from this trend, as proactive health management becomes a priority for both patients and healthcare systems.