Research Methodology on Network Engineering Services Market

1. Introduction

The research methodology is the procedure and planning followed to attain the objectives of a research study. The methodology taken that consists of the type of research design, sources of documents and data, target population selection, data collection instruments, sample size, and data analysis technique along with its interpretation is known as Research Methodology. Research Methodology is the foundation of any research and Market Research Future's Network Engineering Services Market report, 2023-2030, has been formulated with careful consideration of market research methodology and its approaches.

2. Research Design

This research for the Network Engineering Services Market report, 2023-2030, has been designed to adopt both a qualitative and quantitative approach. The qualitative aspect provides an overview of the market, primary interviews with experts and a SWOT analysis. The quantitative approach has been used to determine the market size and market forecast through secondary resources such as major associations, and industry forums.

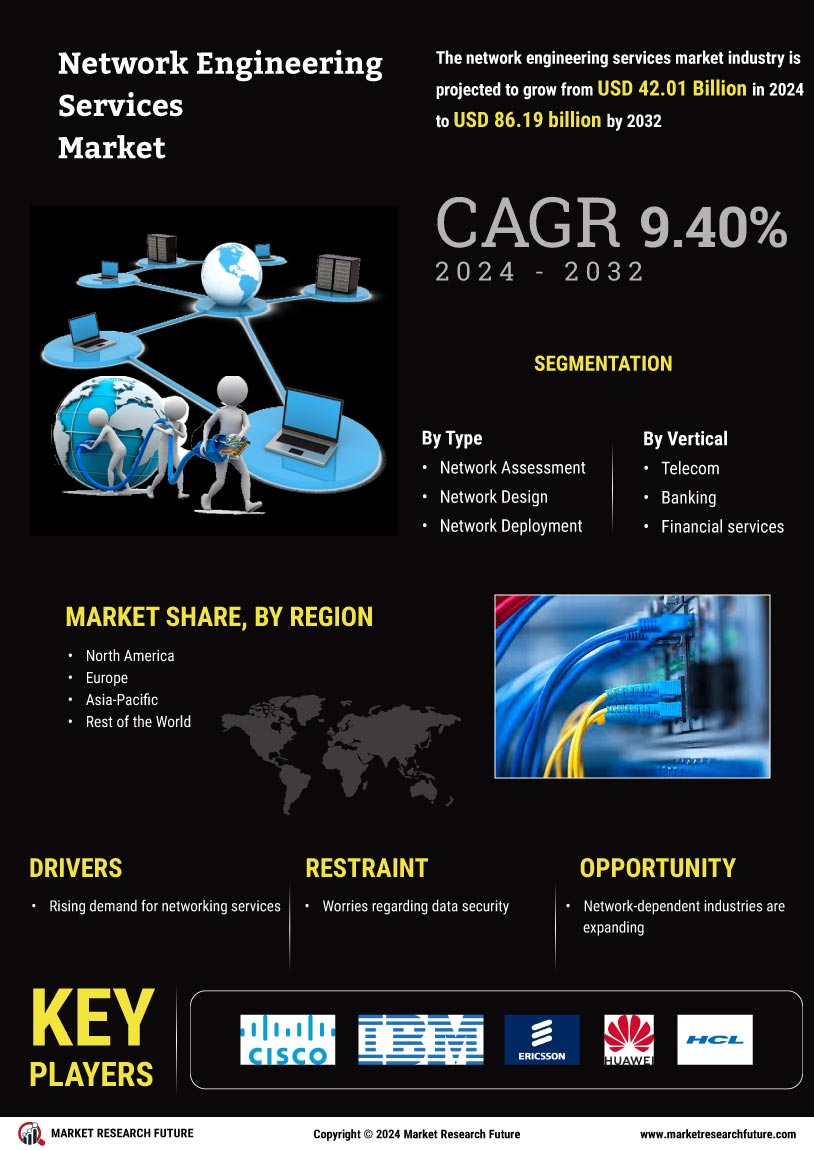

3. Scope of the Study

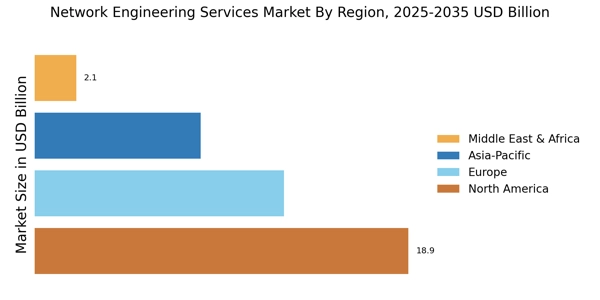

This research report about the Network Engineering Services Market report, 2023-2030, is a thorough analysis of the market conditions which encapsulates industry trends, regional analysis, competitive landscape and opportunities for investors and manufacturers. The key regional markets for the Network Engineering Services Market are North America, Europe, Asia-Pacific and the rest of the world.

4. Sources and Primary Research Focus

The primary research methodology employed for the Network Engineering Services Market report was a comprehensive discussion and analysis of the industry, competitive market, and the development of market trends. This was conducted through the use of interviews and discussions with prominent experts and major executives in the market. The data used in this Network Engineering Services Market report derives from various sources such as press releases, white papers, industry journals, and brand websites.

5. Segmentation

The segmentation of the Network Engineering Services Market has been done based on type, application, size, and region.

6. Data Collection and Validation

Extensive primary research was conducted to collect data from the Internet, interviews with multiple-level market players, and industry experts. Moreover, secondary research sources such as the Market Research Future Library, facts, figures, and industry reports were also studied for analysis. Validation of the collected data was done based on the survey responses received from primary and secondary sources

7. Data Representation

The data has been presented in graphical and tabular format for better understanding and representation.

8. Sample Size

A sample size of 100 people was considered for this report.

9. Research Sample

The research sample was comprised of consumer representatives, industry professionals, and subject matter experts.

10. Probability

The probability that the results reflect accurate information is above 95%.

11. Data Interpretation

Qualitative and quantitative data have been used to understand the current and future trends of the Network Engineering Services Market. The reports have been analyzed with the help of statistical tools such as ratio analysis, Regression analysis, and other techniques. The insight of this report has been calculated which is presented in the form of charts and tables.

Conclusion

This comprehensive research methodology of the Network Engineering Services Market report, 2023-2030, highlights the various methods used to collect data, factors analyzed and studied, and the primary and secondary research approaches adopted. An in-depth analysis of the quantitative and qualitative factors, along with current industry developments and market trends, has been discussed in the report. The research methodology is pivotal for understanding and interpreting the report accurately. It will allow readers to understand the report thoroughly and Plan for the future accordingly.