Rise of Digital Financial Literacy

The increasing emphasis on digital financial literacy appears to be a pivotal driver in the Neo Banking Market. As consumers become more adept at navigating digital platforms, their comfort with online banking solutions grows. This trend is evidenced by a reported increase in the number of individuals utilizing mobile banking applications, which surged to over 1.5 billion users in 2025. Enhanced financial literacy not only empowers consumers to make informed decisions but also fosters trust in digital banking solutions. Consequently, Neo banks are likely to benefit from a more educated customer base that actively seeks innovative financial products. This shift may lead to a more competitive landscape, as traditional banks strive to adapt to the evolving expectations of tech-savvy consumers.

Demand for Seamless User Experience

The demand for a seamless user experience is increasingly shaping the Neo Banking Market. Consumers today expect intuitive interfaces and frictionless transactions, which are hallmarks of neo banks. Research indicates that 75% of users prioritize ease of use when selecting a banking service. This expectation drives neo banks to invest in user-centric design and functionality, ensuring that their platforms are not only accessible but also engaging. As a result, the competition among neo banks intensifies, compelling them to innovate continuously. The focus on user experience may also lead to the development of personalized services, further enhancing customer satisfaction and loyalty. In this context, the ability to deliver a superior user experience could be a decisive factor in attracting and retaining customers.

Shift Towards Cashless Transactions

The shift towards cashless transactions is significantly influencing the Neo Banking Market. As consumers increasingly prefer digital payment methods, the demand for neo banking solutions that facilitate these transactions is on the rise. Data indicates that cashless transactions are projected to account for over 60% of all transactions by 2026. This trend is prompting neo banks to enhance their payment offerings, integrating features such as contactless payments and instant transfers. The convenience and speed associated with cashless transactions are likely to attract a broader customer base, including younger demographics who prioritize digital solutions. Consequently, neo banks that effectively capitalize on this trend may position themselves favorably in a rapidly evolving financial landscape.

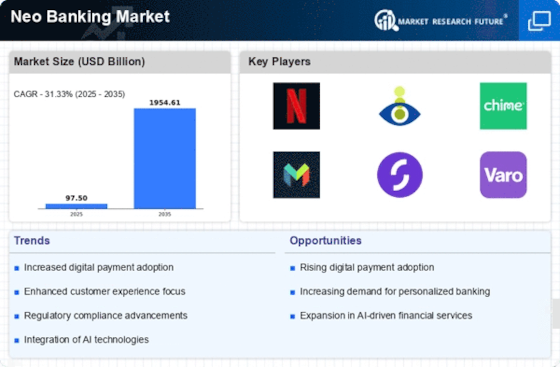

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) technologies is poised to transform the Neo Banking Market. AI applications, such as chatbots and predictive analytics, are becoming increasingly prevalent in banking operations. These technologies enable neo banks to offer personalized services, streamline customer support, and enhance risk management. For instance, AI-driven analytics can provide insights into customer behavior, allowing banks to tailor their offerings accordingly. The adoption of AI is expected to grow, with projections indicating that the market for AI in banking could reach 30 billion dollars by 2027. This technological advancement not only improves operational efficiency but also enhances customer engagement, positioning neo banks as leaders in innovation within the financial sector.

Regulatory Support for Digital Banking

Regulatory support for digital banking initiatives is emerging as a crucial driver in the Neo Banking Market. Governments and regulatory bodies are increasingly recognizing the potential of neo banks to enhance financial inclusion and stimulate economic growth. For instance, several jurisdictions have introduced favorable regulations that facilitate the establishment and operation of digital banks. This supportive regulatory environment is likely to encourage new entrants into the market, fostering competition and innovation. Moreover, as regulatory frameworks evolve, they may provide clearer guidelines for compliance, thereby reducing barriers to entry for aspiring neo banks. This trend suggests that the neo banking sector could experience accelerated growth, as more players enter the market, driven by a conducive regulatory landscape.