Rising Healthcare Expenditure

India's healthcare expenditure has been on an upward trajectory, which is positively impacting the nasal mucosa-drug-supply-device market. With the government and private sectors increasing their investments in healthcare infrastructure, there is a growing focus on advanced medical technologies. The healthcare expenditure in India is expected to reach approximately $370 billion by 2025, which could lead to enhanced accessibility and affordability of nasal drug delivery devices. This increase in spending is likely to facilitate the adoption of innovative nasal mucosa-drug-supply devices, as healthcare providers seek to improve patient outcomes and streamline treatment processes. Consequently, the nasal mucosa-drug-supply-device market stands to benefit from this trend, as more resources are allocated towards effective drug delivery solutions.

Growing Awareness of Preventive Healthcare

The rising awareness of preventive healthcare in India is significantly influencing the nasal mucosa-drug-supply-device market. As individuals become more health-conscious, there is a shift towards preventive measures, including vaccinations and early interventions for respiratory conditions. This trend is likely to drive the demand for nasal drug delivery systems, which are often used for vaccines and other preventive treatments. The Indian government has been promoting vaccination programs, which could further bolster the market for nasal mucosa-drug-supply devices. With an increasing focus on preventive healthcare, the market is expected to witness substantial growth, as healthcare providers and patients alike recognize the benefits of nasal drug delivery systems in preventing diseases.

Technological Innovations in Drug Formulation

Technological innovations in drug formulation are playing a crucial role in shaping the nasal mucosa-drug-supply-device market. Advances in nanotechnology and biopharmaceuticals are enabling the development of more effective and targeted nasal drug delivery systems. These innovations are likely to enhance the bioavailability of drugs administered through the nasal route, making them a preferred choice for both patients and healthcare professionals. In India, research institutions and pharmaceutical companies are increasingly collaborating to explore novel formulations that can improve therapeutic outcomes. As a result, the nasal mucosa-drug-supply-device market is expected to benefit from these advancements, as they pave the way for more efficient and reliable drug delivery options.

Supportive Government Policies and Initiatives

Supportive government policies and initiatives are fostering growth in the nasal mucosa-drug-supply-device market. The Indian government has been actively promoting the development and adoption of advanced medical technologies through various schemes and incentives. Initiatives aimed at enhancing healthcare access and affordability are likely to create a conducive environment for the growth of nasal drug delivery systems. For instance, the introduction of policies that encourage research and development in the pharmaceutical sector could lead to increased innovation in nasal mucosa-drug-supply devices. This supportive regulatory framework is expected to stimulate market growth, as manufacturers are encouraged to invest in the development of new and improved nasal drug delivery solutions.

Increasing Demand for Non-Invasive Delivery Systems

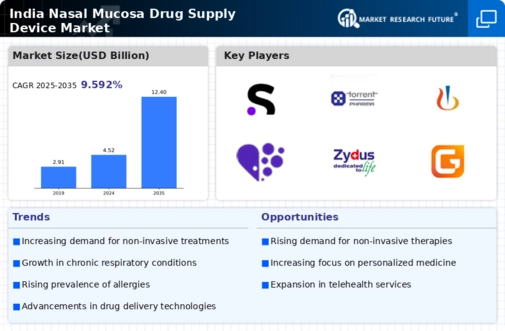

The nasal mucosa-drug-supply-device market is experiencing a notable surge in demand for non-invasive drug delivery systems. Patients and healthcare providers are increasingly favoring these systems due to their ease of use and reduced discomfort compared to traditional methods. This trend is particularly pronounced in India, where the growing awareness of patient-centric healthcare solutions is driving market growth. The market for nasal drug delivery devices is projected to expand at a CAGR of approximately 10% over the next five years, reflecting a shift towards more user-friendly options. As a result, manufacturers are investing in innovative technologies to enhance the efficacy and safety of nasal drug delivery systems, thereby contributing to the overall growth of the nasal mucosa-drug-supply-device market.