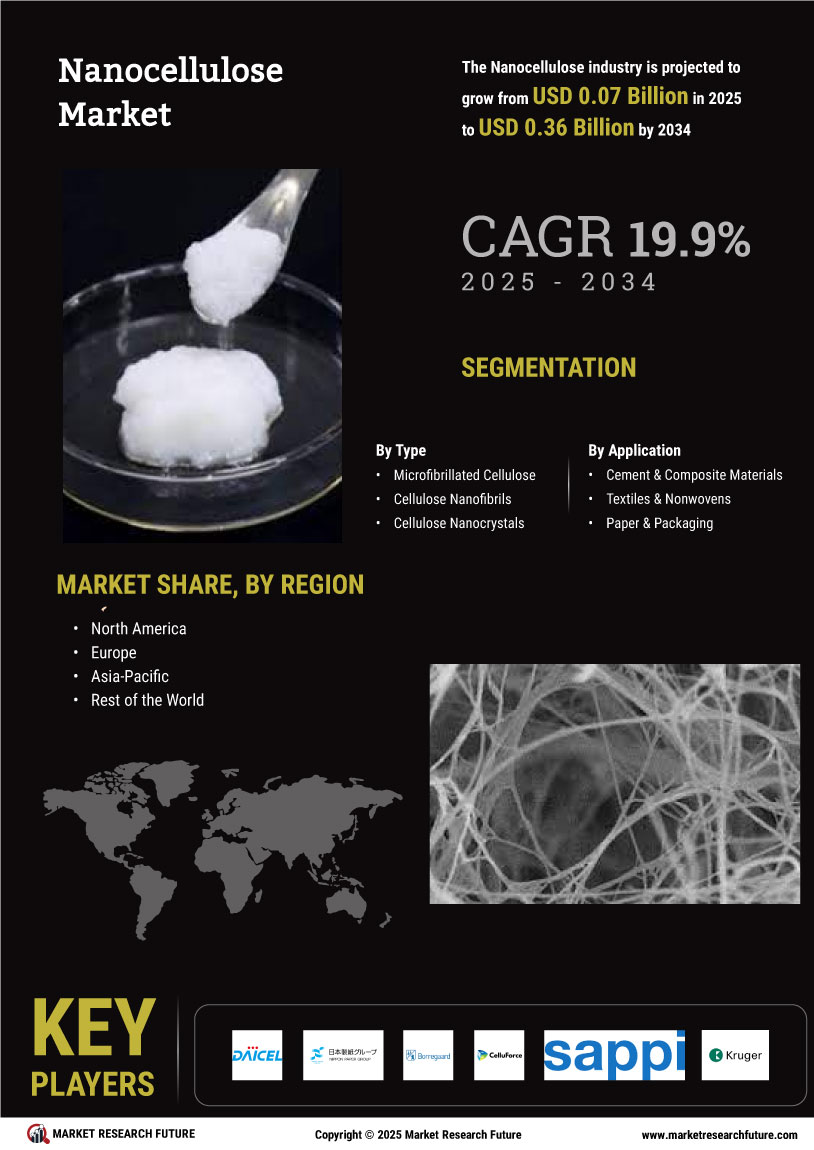

Market Growth Projections

The Global Nanocellulose Market Industry is projected to witness substantial growth over the coming years. With a market value of approximately 0.06 USD Billion in 2024, it is anticipated to reach 0.43 USD Billion by 2035. This growth trajectory is underpinned by a compound annual growth rate (CAGR) of 19.65% from 2025 to 2035. Such projections indicate a robust demand for nanocellulose across various sectors, driven by its unique properties and increasing applications. The market's expansion reflects a broader trend towards innovative materials that meet the evolving needs of industries and consumers alike.

Advancements in Nanotechnology

Technological advancements in nanotechnology are significantly influencing the Global Nanocellulose Market Industry. Innovations in production techniques and applications are enhancing the performance characteristics of nanocellulose, making it more appealing for various sectors, including packaging, biomedical, and electronics. These advancements facilitate the development of high-performance materials that can outperform conventional options. As a result, the market is poised for substantial growth, with a projected compound annual growth rate (CAGR) of 19.65% from 2025 to 2035. This growth trajectory underscores the transformative potential of nanotechnology in expanding the applications of nanocellulose.

Rising Demand for Sustainable Materials

The Global Nanocellulose Market Industry is experiencing a notable surge in demand for sustainable materials. As environmental concerns escalate, industries are increasingly seeking eco-friendly alternatives to traditional materials. Nanocellulose Market, derived from renewable sources, offers a biodegradable and non-toxic option that aligns with sustainability goals. In 2024, the market is valued at approximately 0.06 USD Billion, reflecting a growing recognition of its potential. This trend is likely to continue, as consumers and manufacturers alike prioritize sustainability, potentially propelling the market towards a projected value of 0.43 USD Billion by 2035.

Growing Applications in Various Industries

The versatility of nanocellulose is driving its adoption across multiple industries, thereby propelling the Global Nanocellulose Market Industry. Applications in sectors such as packaging, automotive, and construction are expanding, as nanocellulose offers unique properties like enhanced strength and lightweight characteristics. For instance, in packaging, nanocellulose is utilized to create biodegradable films that reduce plastic waste. This broad applicability is likely to sustain market growth, as industries increasingly recognize the benefits of incorporating nanocellulose into their products. The market's expansion is indicative of a broader trend towards innovative materials that meet diverse industrial needs.

Regulatory Support for Biodegradable Materials

Regulatory frameworks promoting biodegradable materials are significantly influencing the Global Nanocellulose Market Industry. Governments worldwide are implementing policies aimed at reducing plastic waste and encouraging the use of sustainable materials. This regulatory support is creating a favorable environment for the adoption of nanocellulose, as it aligns with global sustainability initiatives. As regulations become more stringent, industries are likely to shift towards biodegradable alternatives, further driving demand for nanocellulose. This trend is expected to contribute to the market's growth, reinforcing the importance of regulatory frameworks in shaping industry dynamics.

Increasing Investment in Research and Development

Investment in research and development is a critical driver for the Global Nanocellulose Market Industry. Governments and private entities are allocating significant resources to explore the diverse applications of nanocellulose, ranging from food packaging to drug delivery systems. This influx of funding is fostering innovation and accelerating the commercialization of nanocellulose-based products. As research progresses, new applications are likely to emerge, further expanding the market. The anticipated growth in R&D investment is expected to contribute to the market's expansion, aligning with the projected increase in market value from 0.06 USD Billion in 2024 to 0.43 USD Billion by 2035.