Major market players are spending a lot of capitals on R&D to enhance their product lines, which will aid the Plastic Packaging Market expand. Market players are also taking a range of strategic measures to expand their worldwide footprint, with prime market developments such as new product innovations & launches, contracts & agreements, mergers and acquisitions, better investments, and collaboration & strategic partnerships with other organizations in the plastic packaging market. Competitors in the plastic packaging industry must offer cost-effective items to extend and survive in an increasingly high competitive and expanding market environment.

One of the primary business strategies adopted by manufacturers in the plastic packaging industry to benefit clients and expand the market sector is to manufacture locally to reduce operating costs. In recent years, plastic packaging manufacturer has provided with some of the most significant benefits. The plastic packaging manufacturers major player such as

Amcor Ltd (Australia), Wipak Group (Finland), Ampac Holdings LLC (US),

BASF SE (Germany), Saint-Gobain (France), and others are working to drive the market growth via investing heavily in research and development activities.

Amcor (Australia) is a company that offers packaging services. Pet bottles, plastic bottles and jars, capsules and closures, customized folding cartons, free films, bags and pouches, wrappers, rigid containers, laminates, and flow packs are just a few of the plastic, fiber, metal, and glass packaging goods it provides.

In January Amcor will present how it is redefining dairy packaging by providing more sustainable solutions and cutting-edge design and delivery, prolonging shelf life for consumers, as the headline sponsor of the 2021 International Dairy Forum. Amcor will also demonstrate the most recent advancements in dairy packaging and sustainability.

Also, Saint-Gobain (France) creates, produces, and distributes products essential to everyone's future well-being and our own. Products from Saint-Gobain are ideal for the packaging industry because they offer a durable, non-stick-release surface and chemical and high-temperature resistance. In manufacturing plastic bags, heat shrinking, sealing, and metal food confinement are common applications.

In April the brilliant idea to offer to use the plastic often used to package its goods to produce aprons for healthcare workers came from Saint-Placo.

Gobain's Placo sent its plastic packaging to nearby businesses to create protective garments for medical crews after passing the initial tests with flying colors.

SABIC, a global chemical industry leader in April 2024 rolled out the first-ever circular packaging project in Saudi Arabia as part of its TRUCIRCLE program aimed at speeding up the implementation of a circular plastic economy. The Oat Arabic Bread from FONTE, one of the key players in the bakery industry in the Kingdom of Saudi Arabia (KSA), now comes with bread bags made out of SABIC’s certified circular polyethylene (PE).

Napco National, a vertically integrated Saudi producer of flexible film and packaging products, manufactures these bags by using two food contact-approved grades of circular polyethylene resin (LLDPE) from the TRUCIRCLE catalog offered by SABIC. Starting March 2023, when this joint project was launched, and continuing until May 2023, when this experiment was successfully accomplished at Napco, FONTE has begun distributing these flexible bags throughout supermarkets located across Saudi Arabia.

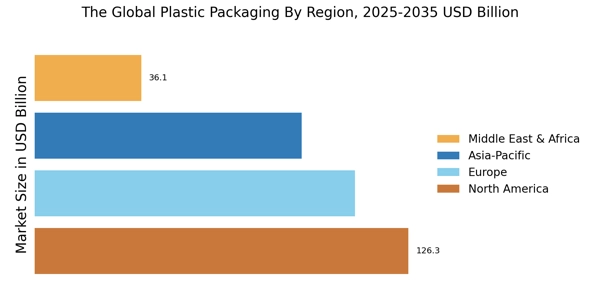

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

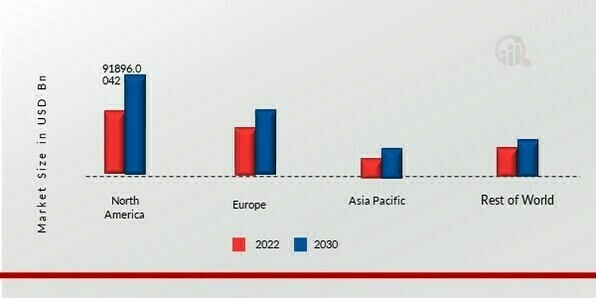

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review