Geopolitical Influences

Geopolitical tensions and conflicts are pivotal drivers of the Multiple Launch Rocket System Market. Nations are increasingly investing in advanced military capabilities to deter potential threats and enhance their defense posture. The ongoing conflicts in various regions have prompted countries to modernize their artillery and missile systems, leading to a heightened demand for multiple launch rocket systems. For example, defense budgets in several countries have seen significant increases, with allocations for missile systems rising by over 10% in some cases. This trend indicates a robust market environment, as nations prioritize the acquisition of advanced systems to maintain strategic advantages. The interplay of international relations and defense strategies will likely continue to shape the market landscape.

Increased Defense Budgets

The rise in defense budgets across various nations is a significant driver of the Multiple Launch Rocket System Market. Governments are recognizing the need to bolster their military capabilities in response to evolving security threats. Recent reports indicate that defense spending has increased by an average of 3.5% annually, with a notable portion allocated to missile systems. This trend is particularly evident in regions facing heightened security challenges, where nations are prioritizing the acquisition of advanced multiple launch rocket systems. The influx of funding is likely to stimulate innovation and competition among manufacturers, leading to the development of more sophisticated systems. As defense budgets continue to rise, the market is poised for sustained growth.

Technological Advancements

The Multiple Launch Rocket System Market is experiencing a surge in technological advancements that enhance the capabilities of rocket systems. Innovations in precision targeting, automation, and missile guidance systems are transforming the operational effectiveness of these systems. For instance, the integration of advanced sensors and artificial intelligence is enabling more accurate targeting and reduced collateral damage. According to recent data, the market is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years, driven by these technological improvements. Furthermore, the development of next-generation rocket systems, which can deliver a higher payload and operate in diverse environments, is likely to attract increased investment and interest from military organizations worldwide.

Integration of Multi-Domain Operations

The integration of multi-domain operations is reshaping the Multiple Launch Rocket System Market. Military forces are increasingly adopting strategies that encompass land, air, sea, space, and cyber domains, necessitating advanced rocket systems that can operate seamlessly across these environments. This shift is driving demand for systems that can provide rapid response capabilities and support joint operations. As a result, manufacturers are focusing on developing versatile systems that can be integrated with other military assets, enhancing overall operational effectiveness. The market is expected to witness a growth rate of around 4.8% as defense forces seek to enhance interoperability and coordination among various platforms. This trend underscores the importance of adaptability in modern military operations.

Emerging Markets and Defense Modernization

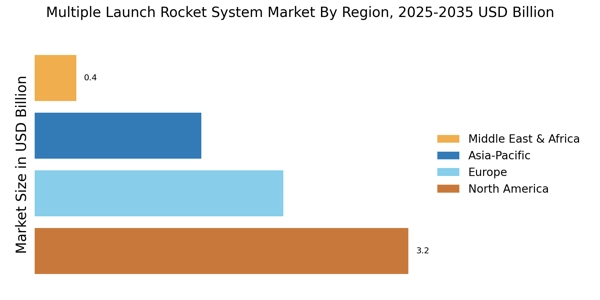

Emerging markets are becoming increasingly important in the Multiple Launch Rocket System Market as countries seek to modernize their defense capabilities. Nations in Asia, the Middle East, and Africa are investing in advanced military technologies to address regional security concerns. This modernization trend is driving demand for multiple launch rocket systems, as these countries aim to enhance their deterrence capabilities. For instance, several nations have initiated programs to upgrade their existing artillery systems, with investments projected to reach billions of dollars over the next decade. The focus on indigenous production and technology transfer is also likely to create opportunities for collaboration between local manufacturers and established defense contractors. This dynamic is expected to contribute to the overall growth of the market.