Mouth Fresheners Size

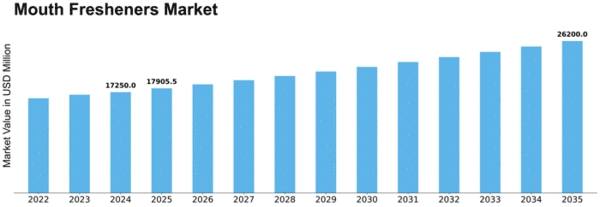

Mouth Fresheners Market Growth Projections and Opportunities

The market of mouth fresheners is a fluid one that is controlled by various factors and in turn shapes the preference of consumers and trends within the industry. At its core this market is driven by consumer quest for fresh breath as well as oral hygiene, hence they are looking for simple and enjoyable solutions. One significant aspect defining dynamic nature of this market is broad range of flavors consumers prefer. The market satisfies variety needs from conventional mint flavors to exotic ones such as fruit-based or herbal blends where individuals can buy breath refreshers based on their taste preferences. Lifestyle changes and a growing concern for health and wellness are highly influential in shaping mouth freshener market dynamics. There has been an increase in customer demand for sugar-free or natural ingredient based mouth fresheners due to shifts towards healthier options in the food and beverage sector. In order to meet this increasing demand, manufacturers have come up with products that do more than just giving you fresh breath. Some mouth refresher brands currently contain herbs like fennel or mint that aid with digestion naturally or reduce anxiety. In addition, cultural influences also determine how mouth freshener markets operate with some regions preferring different flavors and ingredients from others. While certain cultures find it appropriate to put traditional spices into mouth fresheners, others prefer fruity flavours while some may enjoy menthol’s coolness . This cultural diversity makes it very versatile thus adaptable to the tastes and preferences existing in each region.

Moreover, packaging and presentation greatly influence consumer choices made in the mouth fresheners market. Packaging that stands out on the shelf, convenience formats as well as portability are vital when customers look for products fitting into their busy lives. Besides, manufactures have employed innovative methods of packaging such pocket dispensers among other eco-friendly devices aimed at improving both aesthetic appeal and sustainability of their items. Brand loyalty as well as marketing strategies have substantial impacts on these dynamics making most customers go back to those companies which provide quality. In this regard advertising campaigns and social media engagement are some of the marketing efforts which strongly affect consumer perception as they help in creating awareness about companies’ brands. The mouth fresheners market is a combination of big firms and new entrants thus fostering both competition as well as innovation. Established brands often focus on expanding their product portfolios through research and development, while smaller players may emphasize niche markets or artisanal offerings to carve out a distinctive identity.

Leave a Comment