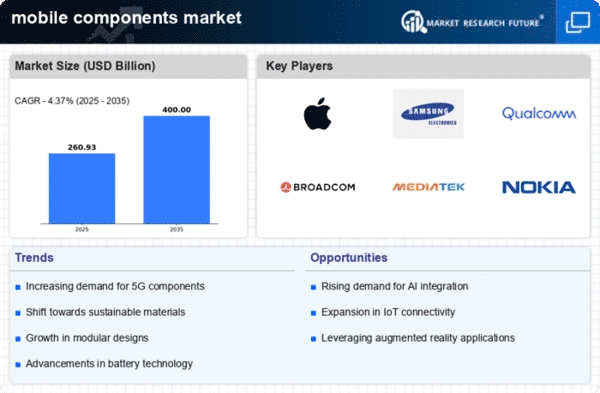

The mobile components market is characterized by intense competition and rapid technological advancements, driven by the increasing demand for smartphones and other mobile devices. Key players such as Apple Inc (US), Samsung Electronics (KR), and Qualcomm Inc (US) are at the forefront, each adopting distinct strategies to maintain their competitive edge. Apple Inc (US) focuses on innovation and premium product offerings, while Samsung Electronics (KR) emphasizes a broad product range and aggressive marketing. Qualcomm Inc (US) is heavily invested in R&D, particularly in 5G technology, which positions it as a leader in mobile connectivity solutions. Collectively, these strategies contribute to a dynamic competitive environment, where differentiation is increasingly based on technological prowess rather than price alone.In terms of business tactics, companies are localizing manufacturing to mitigate supply chain disruptions and optimize costs. The market structure appears moderately fragmented, with several players vying for market share, yet dominated by a few key firms that wield substantial influence. This competitive landscape is shaped by the strategic maneuvers of these major companies, which often set the tone for industry standards and practices.

In November Samsung Electronics (KR) announced a partnership with a leading semiconductor manufacturer to enhance its chip production capabilities. This strategic move is likely to bolster Samsung's supply chain resilience and ensure a steady supply of high-performance components for its mobile devices. Such partnerships are indicative of a broader trend where companies seek to secure their supply chains amid global uncertainties.

In October Qualcomm Inc (US) unveiled its latest Snapdragon processor, designed to optimize AI capabilities in mobile devices. This launch underscores Qualcomm's commitment to integrating advanced technologies into its products, potentially setting new benchmarks for performance in the mobile components market. The emphasis on AI integration reflects a growing trend where companies are not only competing on hardware specifications but also on the intelligence and efficiency of their devices.

In September Apple Inc (US) expanded its manufacturing footprint in India, aiming to diversify its production base. This strategic decision is likely to enhance Apple's operational flexibility and reduce dependency on its traditional manufacturing hubs. By localizing production, Apple may also benefit from favorable government policies and a burgeoning consumer market in India, which could further solidify its market position.

As of December the mobile components market is witnessing trends such as digitalization, sustainability, and AI integration, which are reshaping competitive dynamics. Strategic alliances are becoming increasingly vital, as companies recognize the need for collaboration to drive innovation and efficiency. Looking ahead, competitive differentiation is expected to evolve, with a pronounced shift from price-based competition to a focus on technological innovation and supply chain reliability. This transition may redefine how companies position themselves in the market, emphasizing the importance of agility and responsiveness to consumer demands.