Sustainability Initiatives in Mobile Air Compressor Market

Sustainability initiatives are becoming a pivotal driver in the Mobile Air Compressor Market. As environmental regulations tighten, companies are compelled to adopt eco-friendly practices. The shift towards electric and hybrid mobile air compressors is indicative of this trend, as these models produce lower emissions compared to traditional diesel-powered units. Market data suggests that the demand for sustainable solutions is expected to rise, with electric models projected to account for a significant share of the market by 2028. Additionally, manufacturers are investing in research and development to create compressors that utilize renewable energy sources. This focus on sustainability not only meets regulatory requirements but also appeals to environmentally conscious consumers, thereby expanding market opportunities.

Technological Advancements in Mobile Air Compressor Market

The Mobile Air Compressor Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as variable speed drives and advanced control systems enhance efficiency and reduce energy consumption. The integration of IoT technology allows for real-time monitoring and predictive maintenance, which can significantly lower operational costs. According to recent data, the market for mobile air compressors is projected to grow at a CAGR of approximately 5.2% from 2023 to 2028, driven by these technological improvements. Furthermore, manufacturers are increasingly focusing on developing lightweight and portable models, catering to the needs of various sectors, including construction and automotive. This trend not only boosts productivity but also aligns with the growing demand for energy-efficient solutions.

Rising Demand in Construction Sector for Mobile Air Compressor Market

The construction sector is a primary driver of growth in the Mobile Air Compressor Market. As infrastructure projects increase globally, the need for reliable and efficient air compressors becomes paramount. Mobile air compressors are essential for powering pneumatic tools, which are widely used in construction activities. Recent statistics indicate that the construction industry is expected to grow at a rate of 4.5% annually, further fueling the demand for mobile air compressors. Additionally, the trend towards modular construction and off-site fabrication is likely to increase the utilization of mobile air compressors, as they provide flexibility and efficiency on job sites. This rising demand underscores the importance of mobile air compressors in supporting construction activities.

Emerging Markets and Economic Growth Impacting Mobile Air Compressor Market

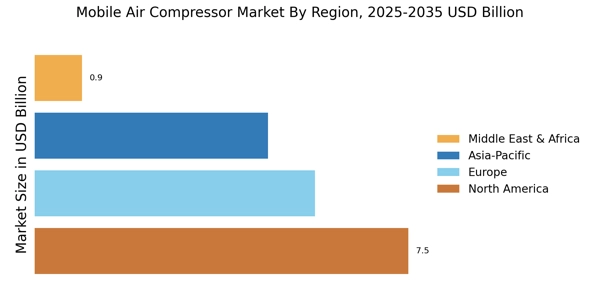

Emerging markets are playing a crucial role in shaping the Mobile Air Compressor Market. As economies in regions such as Asia-Pacific and Latin America continue to grow, the demand for mobile air compressors is expected to rise significantly. Increased industrialization and urbanization in these regions are driving the need for construction and manufacturing activities, which in turn boosts the demand for mobile air compressors. Recent projections suggest that the market in these emerging economies could grow at a CAGR of 6.0% through 2028. This growth is further supported by investments in infrastructure development and the expansion of manufacturing capabilities. Consequently, the Mobile Air Compressor Market is likely to witness substantial opportunities in these regions, as businesses seek efficient and reliable air compression solutions.

Increased Adoption in Automotive Industry within Mobile Air Compressor Market

The automotive industry is increasingly adopting mobile air compressors, which serves as a significant driver for the Mobile Air Compressor Market. These compressors are utilized in various applications, including tire inflation and powering air tools in automotive repair shops. The growing trend of electric vehicles (EVs) is also contributing to this demand, as mobile air compressors are essential for servicing and maintaining EVs. Market analysis indicates that the automotive sector is projected to expand at a CAGR of 3.8% over the next few years, which will likely enhance the demand for mobile air compressors. Furthermore, the need for efficient and portable solutions in automotive manufacturing and repair processes is expected to drive innovation and product development in this segment.