Research Methodology on Mining Explosives Market

Introduction:

The global mining explosives market is projected to witness substantial growth over the forecast period 2023 to 2030. This is due to a surge in the demand for explosives from the global mining and mineral industry, owing to a global upsurge in the exploration and development activities of various metals such as gold, copper, and coal, among others. Technological advancements such as improved specificity, accuracy, and cost-effectiveness of the explosives used in the mining industry are driving the growth of the mining explosives market.

In the current scenario, the digitalization of the explosives industry has attracted a large number of investments. With the help of increasing digitalization, explosives manufacturers are improving the quality of their products while reducing the wastage of explosives. The augmenting demand for safe and environment-friendly products from the mining and mineral industry has prompted explosives manufacturers to focus on special formulations. This, in turn, is driving the growth of the mining explosives market.

Research Methodology:

This research report on the Mining Explosives Market is based on extensive secondary research and primary data collected from different sources, such as industry publications, government publications, trade publications, white papers, market expert interviews, business magazines, and government and non-government organizations, among others.

The research is conducted using market research methodologies such as PESTEL analysis, market analysis, Porter’s five forces analysis, SWOT analysis, market share analysis, and size & share analysis, and qualitative as well as quantitative research techniques.

The entire research report is developed by gaining insights from senior executives, industry analysts, and industry experts, who are well-versed in the mining explosives industry, in terms of advancement and recent trends in the market. Research experts carefully assess the industry trends, their scope, potential opportunities, and upcoming market growths, to understand current and future market trends. Furthermore, the report also includes detailed information on the competitive landscape, market dynamics, key growth drivers, threats and challenges, and strategic initiatives adopted by the major vendors in the mining explosives market.

The data for the research report is obtained from governmental and non-governmental organizations, industry magazines, industry experts, and trade associations. The market data is analysed and validated by industry experts and industry analysts, who are well-trained in the mining explosives industry and have in-depth knowledge of the market dynamics.

Coverage of Report:

This report provides an in-depth analysis of the global mining explosives market by segmenting the market based on types and applications. The report also provides an analysis of the key growth drivers, opportunities, threats, and challenges faced by the market. The report covers the global market size of the mining explosives market and covers the historical growth patterns, current market trends, and future growth prospects.

Scope of the Research:

- Market Segmentation – Segmented by type (blasting agents, primers, boosters, and others), and by application (civil engineering, mining, military, and others).

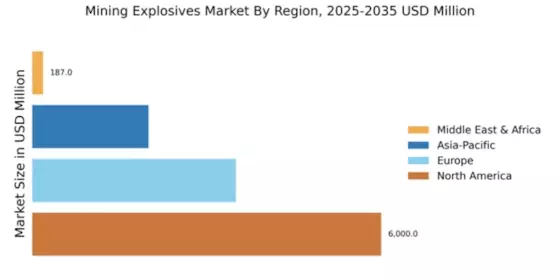

- Regional Coverage – The report covers the global mining explosives market, with the regional markets being analysed into North America, Europe, Asia-Pacific, and the Rest of the World.

- Analysis – The research report includes a detailed analysis of the competitive landscape of the mining explosives market and provides detailed information on the market dynamics, such as drivers, opportunities, threats, and challenges.

- Market Forecasts – The report provides market estimations and forecasts from 2023 to 2030, using both top-down and bottom-up approaches.

Research Objectives:

The main objective of the research report is to analyze the global market for mining explosives, by types and applications. It also focuses on the market dynamics, such as drivers, opportunities, threats, and challenges. Additionally, the report provides information on the recent developments in the Mining Explosives market and covers the market size and projections for 2023 to 2030.