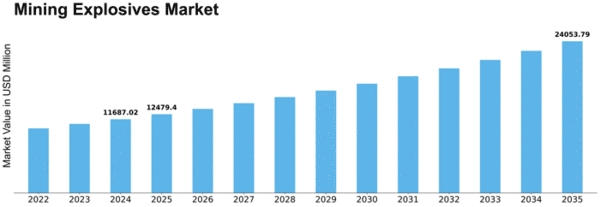

Mining Explosives Size

Mining Explosives Market Growth Projections and Opportunities

The mining explosives market is influenced by a variety of market factors that play a significant role in shaping its dynamics. One of the primary drivers impacting this market is the global demand for minerals and metals. As industrialization and infrastructure development continue to surge worldwide, the need for raw materials such as coal, iron ore, copper, and other metals rises, driving up the demand for mining explosives. Additionally, advancements in technology have led to the adoption of more efficient and powerful explosives, further fueling market growth.

Government regulations and policies also play a crucial role in shaping the mining explosives market. Regulations related to safety standards, environmental protection, and permits for mining operations heavily influence the type and quantity of explosives used in mining activities. Stringent regulations often necessitate the use of safer and more environmentally friendly explosives, which can drive up production costs but also create opportunities for innovation within the industry.

Economic factors such as GDP growth, inflation rates, and investment in infrastructure projects significantly impact the demand for mining explosives. Countries experiencing robust economic growth typically witness increased investments in mining activities to meet the growing demand for raw materials. Conversely, economic downturns may lead to a decrease in mining activities and subsequently lower demand for explosives.

Geopolitical factors such as trade tensions, political instability, and resource nationalism can also affect the mining explosives market. Disruptions in the global supply chain due to geopolitical conflicts or trade disputes can lead to fluctuations in raw material prices, affecting the overall cost of production for mining explosives manufacturers. Furthermore, political instability in key mining regions may disrupt operations, leading to supply shortages or production delays.

In the global mining explosive market, packaged and emulsion explosives are gaining traction. Furthermore, mining resource extraction has resulted in global industrial development, particularly the emergence of new players such as Africa, Latin America, and Asia.

Technological advancements and innovations in mining techniques have a significant impact on the mining explosives market. The development of advanced blasting techniques, such as electronic detonators and precision drilling, has improved the efficiency and safety of mining operations while reducing the environmental impact. These technological innovations not only drive demand for specialized explosives but also create opportunities for manufacturers to offer value-added products and services.

Environmental concerns and sustainability initiatives are increasingly influencing the mining explosives market. With growing awareness of the environmental impact of mining activities, there is a rising demand for eco-friendly explosives that minimize air and water pollution, as well as reduce greenhouse gas emissions. Manufacturers are investing in research and development to develop greener alternatives to traditional explosives, driven by both regulatory requirements and consumer preferences for sustainable products.

Lastly, fluctuations in energy prices, particularly the cost of key raw materials such as ammonium nitrate and fuel, can significantly impact the production costs of mining explosives. Fluctuations in energy prices can affect the overall profitability of mining operations and influence purchasing decisions within the industry. Additionally, volatility in currency exchange rates can also impact the cost of imported raw materials, further complicating pricing strategies for mining explosives manufacturers.

Leave a Comment