Rising Demand for Minerals

The mining explosives market in South America is experiencing a surge in demand driven by the increasing need for minerals such as copper, lithium, and gold. Countries like Chile and Peru are among the largest producers of copper, which is essential for various industries, including electronics and renewable energy. The mining sector's growth is projected to contribute significantly to the regional economy, with estimates suggesting that the mining industry could account for over 10% of GDP in these countries. This heightened demand for minerals necessitates the use of advanced explosives to enhance extraction efficiency, thereby propelling the mining explosives market forward.

International Trade Dynamics

International trade dynamics are playing a pivotal role in shaping the mining explosives market in South America. The region's rich mineral resources attract foreign investment, leading to increased demand for explosives from international suppliers. Countries such as Chile and Peru are major exporters of minerals, which necessitates a steady supply of explosives for mining operations. Additionally, trade agreements within South America are facilitating easier access to advanced explosive technologies from abroad. This interconnectedness is likely to enhance the competitiveness of the mining explosives market, as local companies gain access to innovative products and solutions.

Growing Focus on Safety Practices

The mining explosives market in South America is increasingly influenced by a growing focus on safety practices within the mining industry. Regulatory bodies are implementing stricter safety standards to mitigate risks associated with explosive materials. For example, the introduction of new regulations in Argentina aims to reduce accidents and improve handling procedures for explosives. This shift towards enhanced safety measures is likely to drive demand for high-quality, reliable explosives that comply with these regulations. As mining companies prioritize safety, the market for mining explosives is expected to evolve, with an emphasis on products that meet stringent safety criteria.

Investment in Mining Infrastructure

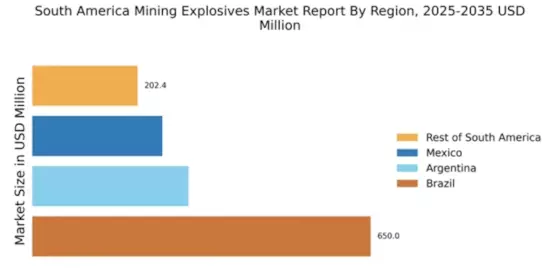

Investment in mining infrastructure across South America is a crucial driver for the mining explosives market. Governments and private entities are channeling substantial funds into developing new mining projects and upgrading existing facilities. For instance, Brazil has announced plans to invest approximately $5 billion in mining infrastructure over the next five years. This influx of capital is likely to boost the demand for explosives, as enhanced infrastructure facilitates larger-scale mining operations. Consequently, the mining explosives market is expected to benefit from this trend, as more efficient operations require advanced blasting techniques and materials.

Technological Innovations in Explosive Formulations

Technological innovations in explosive formulations are reshaping the mining explosives market in South America. The development of more efficient and environmentally friendly explosives is becoming increasingly important. For instance, the introduction of emulsions and water-gel explosives has shown to improve performance while reducing environmental impact. These innovations not only enhance blasting efficiency but also align with the growing demand for sustainable mining practices. As mining companies seek to optimize their operations, the adoption of advanced explosive technologies is likely to drive growth in the mining explosives market.