Rising Demand for Mineral Resources

The Global Mining Flotation Chemicals Market Industry experiences a notable increase in demand for mineral resources, driven by the growing need for metals and minerals in various sectors such as construction, electronics, and automotive. As urbanization accelerates globally, the extraction of essential minerals becomes crucial. This trend is reflected in the projected market size of 2.08 USD Billion in 2024, which is expected to expand as industries continue to seek efficient extraction methods. The demand for flotation chemicals, which enhance the recovery of valuable minerals, is likely to rise, indicating a robust growth trajectory for the industry.

Growing Demand for Specialty Chemicals

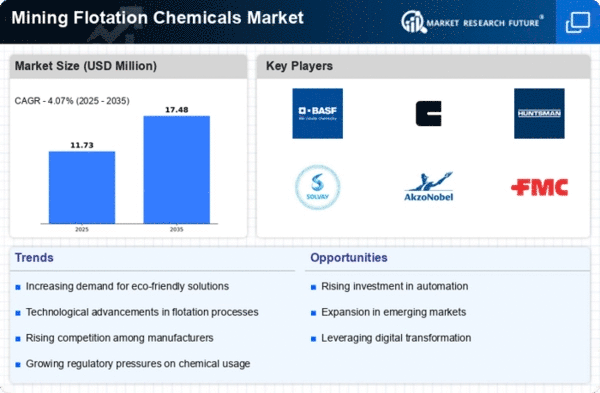

The Global Mining Flotation Chemicals Market Industry is witnessing a surge in demand for specialty chemicals tailored for specific mineral processing needs. These chemicals are designed to enhance the efficiency of flotation processes, leading to improved recovery rates and lower operational costs. As mining operations become more complex, the need for customized flotation solutions is likely to increase. This trend is supported by a projected compound annual growth rate (CAGR) of 3.7% from 2025 to 2035, suggesting that the market for specialty flotation chemicals will expand as mining companies seek to optimize their operations.

Increasing Investment in Mining Exploration

Investment in mining exploration is a critical driver for the Global Mining Flotation Chemicals Market Industry. As mineral reserves become more challenging to access, mining companies are allocating substantial resources to explore new deposits. This trend is evident in the projected market growth, with an expected increase to 3.1 USD Billion by 2035. The exploration phase often requires advanced flotation chemicals to optimize the extraction process, thereby driving demand. Consequently, the industry's growth is closely linked to the level of investment in exploration activities, indicating a positive outlook for flotation chemical suppliers.

Technological Advancements in Flotation Processes

Technological innovations play a pivotal role in shaping the Global Mining Flotation Chemicals Market Industry. The introduction of advanced flotation technologies, such as column flotation and microbubble flotation, enhances mineral recovery rates and reduces operational costs. These advancements not only improve the efficiency of flotation processes but also minimize environmental impacts, aligning with global sustainability goals. As mining companies increasingly adopt these technologies, the demand for specialized flotation chemicals is anticipated to grow. This trend suggests a potential increase in market value, contributing to the overall growth of the industry.

Environmental Regulations and Sustainability Initiatives

The Global Mining Flotation Chemicals Market Industry is significantly influenced by stringent environmental regulations and sustainability initiatives. Governments worldwide are implementing policies aimed at reducing the environmental footprint of mining operations. This shift encourages the adoption of eco-friendly flotation chemicals that comply with regulatory standards. As mining companies strive to enhance their sustainability practices, the demand for biodegradable and less toxic flotation agents is likely to increase. This trend not only supports environmental conservation but also positions the industry for growth, as companies seek to align with global sustainability objectives.