Aging Population

The aging population plays a crucial role in shaping the Minimally-Invasive Cosmetic Procedures Market. As individuals age, they often seek ways to maintain a youthful appearance, leading to increased demand for minimally-invasive treatments. The demographic shift towards an older population, particularly in developed regions, suggests a growing market for procedures that address age-related concerns such as wrinkles and sagging skin. Data indicates that individuals aged 40 and above are among the highest consumers of these procedures, driving market growth. This trend highlights the potential for the Minimally-Invasive Cosmetic Procedures Market to cater to an aging demographic that prioritizes aesthetic maintenance and enhancement.

Advancements in Technology

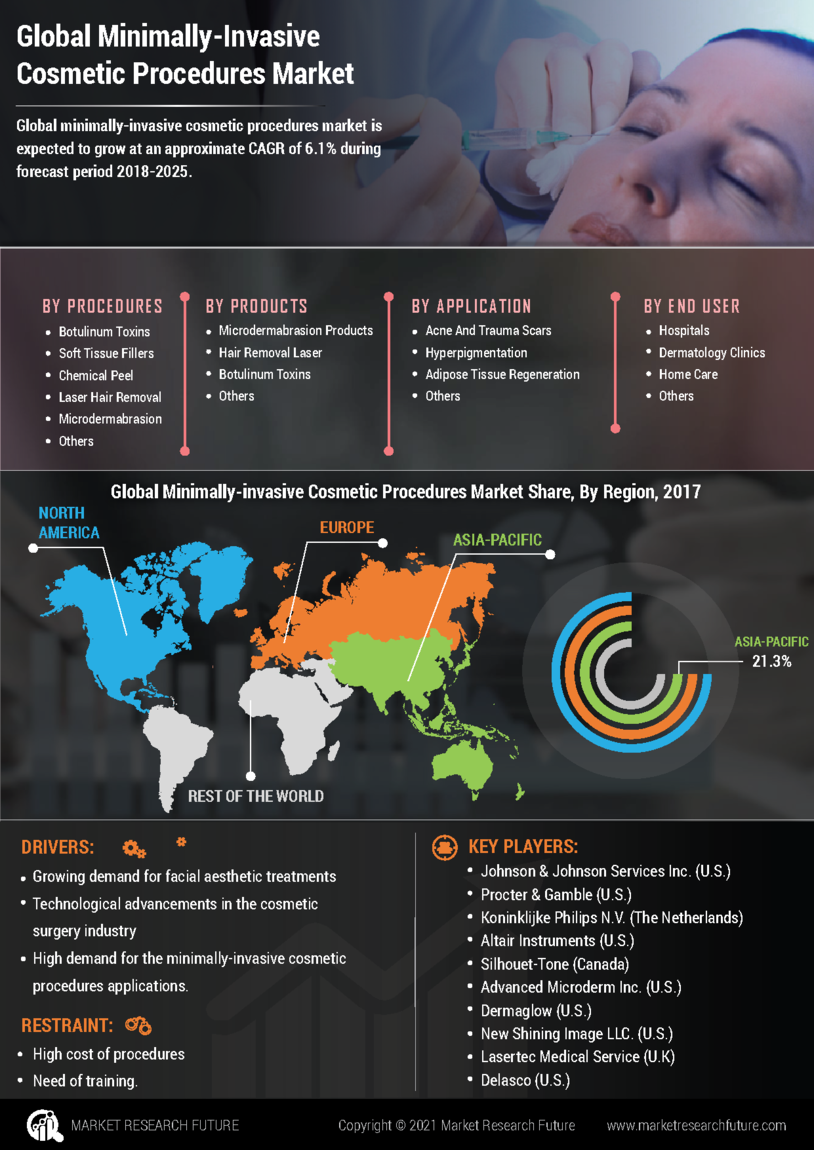

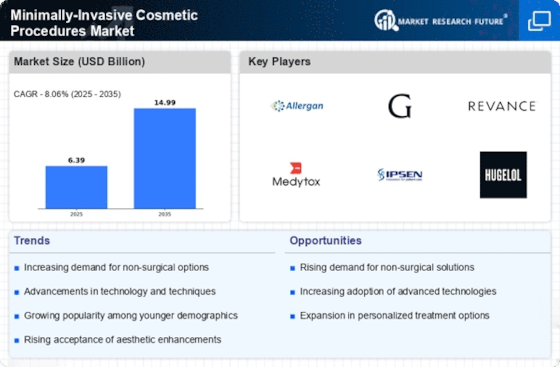

Technological advancements significantly influence the Minimally-Invasive Cosmetic Procedures Market. Innovations in laser technology, ultrasound, and radiofrequency have enhanced the efficacy and safety of various procedures. These advancements not only improve patient outcomes but also expand the range of available treatments. For instance, new techniques in fat reduction and skin tightening have emerged, attracting a broader clientele. The integration of technology into these procedures has led to increased precision and reduced recovery times, making them more appealing to consumers. As technology continues to evolve, the Minimally-Invasive Cosmetic Procedures Market is expected to benefit from ongoing improvements that enhance treatment options and patient satisfaction.

Increasing Demand for Non-Surgical Options

The Minimally-Invasive Cosmetic Procedures Market experiences a notable surge in demand for non-surgical options. Consumers increasingly prefer procedures that offer aesthetic enhancements without the need for extensive recovery times associated with traditional surgeries. This trend is reflected in the rising popularity of treatments such as Botox and dermal fillers, which have seen a significant uptick in usage. According to recent data, the market for these procedures is projected to grow at a compound annual growth rate of approximately 10% over the next several years. This shift towards non-invasive solutions indicates a broader acceptance of cosmetic enhancements, suggesting that the Minimally-Invasive Cosmetic Procedures Market is likely to continue expanding as more individuals seek accessible and less invasive options.

Influence of Social Media and Celebrity Culture

The influence of social media and celebrity culture significantly impacts the Minimally-Invasive Cosmetic Procedures Market. Platforms such as Instagram and TikTok have become powerful tools for promoting cosmetic procedures, with influencers and celebrities showcasing their experiences. This visibility not only normalizes cosmetic enhancements but also drives demand among followers who aspire to similar results. The trend of sharing before-and-after images and personal testimonials has created a culture of openness regarding cosmetic procedures. As a result, the Minimally-Invasive Cosmetic Procedures Market is likely to see continued growth, fueled by the desire of consumers to achieve the aesthetic ideals portrayed in social media.

Rising Awareness and Acceptance of Cosmetic Procedures

Rising awareness and acceptance of cosmetic procedures contribute significantly to the growth of the Minimally-Invasive Cosmetic Procedures Market. As societal norms evolve, more individuals are open to the idea of enhancing their appearance through cosmetic interventions. Educational campaigns and media portrayals have demystified these procedures, making them more accessible and acceptable. This cultural shift is reflected in the increasing number of consultations and procedures performed annually. Market data suggests that the acceptance of cosmetic enhancements is particularly pronounced among younger demographics, indicating a potential for sustained growth in the Minimally-Invasive Cosmetic Procedures Market as these individuals age and continue to seek aesthetic improvements.