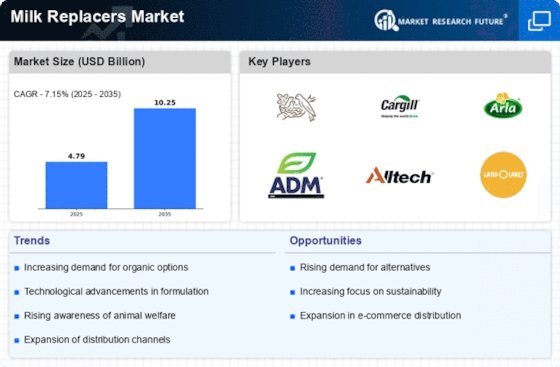

Expansion of E-commerce Platforms

The expansion of e-commerce platforms is transforming the Milk Replacers Market by providing consumers with greater access to a variety of products. Online retailing has become increasingly popular, allowing consumers to purchase milk replacers conveniently from the comfort of their homes. This trend is particularly beneficial for niche products that may not be readily available in traditional retail outlets. As e-commerce continues to grow, it is expected that the market for milk replacers will also expand, as consumers seek out specialized formulations and brands. This shift towards online purchasing could potentially reshape distribution strategies within the industry, encouraging manufacturers to enhance their online presence.

Growing Awareness of Animal Welfare

The increasing awareness of animal welfare is significantly influencing the Milk Replacers Market. Consumers and producers alike are becoming more conscious of the ethical implications of animal husbandry practices. This heightened awareness is prompting livestock producers to adopt more humane practices, including the use of high-quality milk replacers that support the health and well-being of young animals. As a result, there is a growing demand for products that not only meet nutritional standards but also align with ethical considerations. This trend is likely to drive innovation and product development in the milk replacers market, as companies strive to meet the expectations of socially responsible consumers.

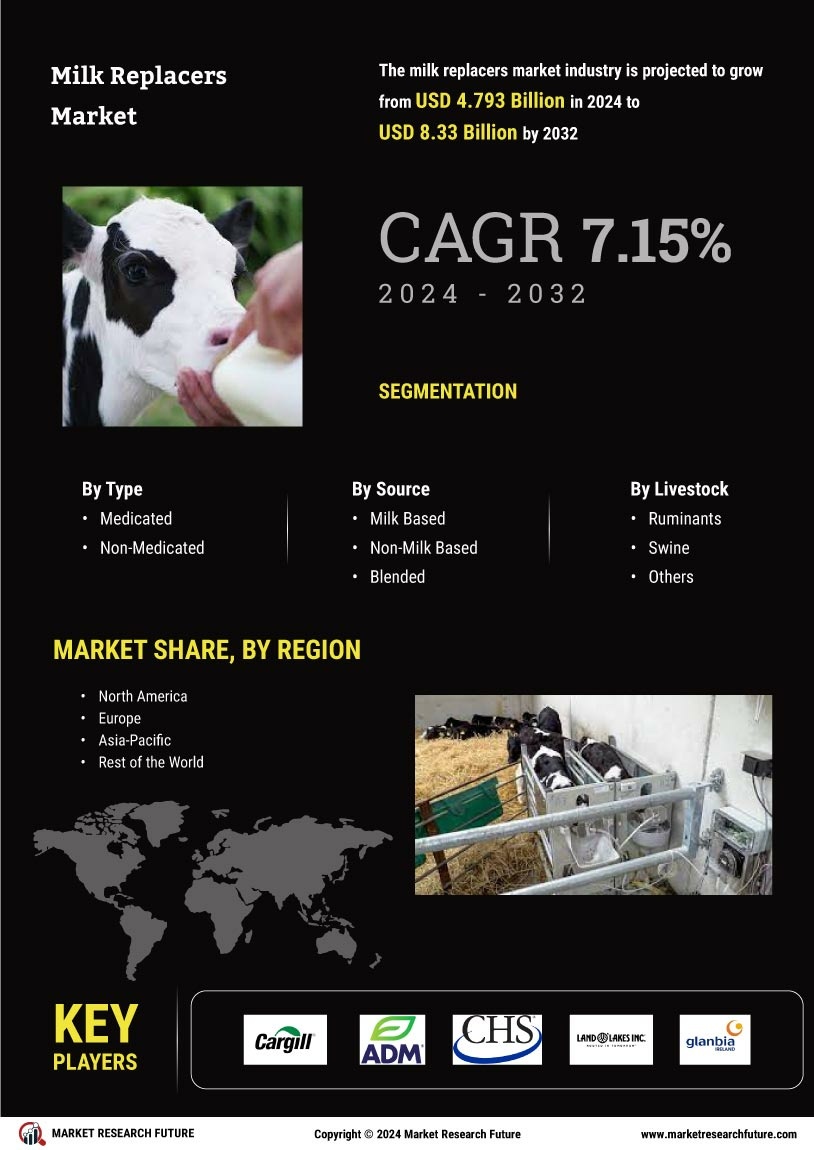

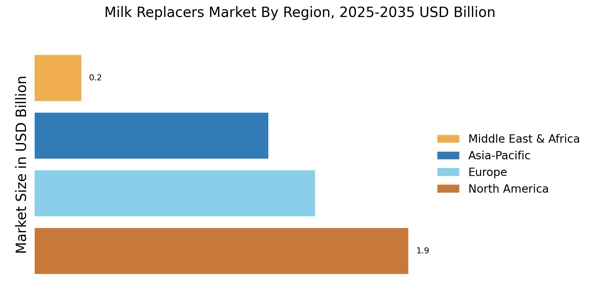

Rising Demand for Dairy Alternatives

The Milk Replacers Market is experiencing a notable surge in demand for dairy alternatives, driven by changing consumer preferences towards plant-based diets. This shift is largely influenced by health consciousness and the growing awareness of lactose intolerance among various populations. As consumers increasingly seek nutritious and sustainable options, the market for milk replacers is projected to expand significantly. According to recent estimates, the market could witness a compound annual growth rate of approximately 7% over the next few years. This trend indicates a robust opportunity for manufacturers to innovate and diversify their product offerings, catering to a broader audience that prioritizes health and sustainability.

Increased Investment in Animal Nutrition

Investment in animal nutrition is a critical driver for the Milk Replacers Market, as livestock producers seek to enhance the health and productivity of their animals. The focus on optimizing feed efficiency and improving growth rates has led to a greater reliance on high-quality milk replacers. Recent data suggests that the global market for animal nutrition is expected to reach USD 200 billion by 2025, with a significant portion allocated to milk replacers. This trend underscores the importance of quality nutrition in livestock management, as producers aim to meet the rising demand for animal products while ensuring animal welfare and sustainability.

Technological Innovations in Formulation

Technological advancements in the formulation of milk replacers are reshaping the Milk Replacers Market. Innovations such as the incorporation of probiotics, prebiotics, and specialized nutrients are enhancing the nutritional profile of these products. These developments not only improve the health and growth rates of young animals but also address specific dietary needs. The market is witnessing a shift towards more sophisticated formulations that cater to the unique requirements of various species. As a result, manufacturers are investing in research and development to create tailored solutions, which could potentially lead to a more competitive landscape in the milk replacers sector.