Shifts in Dietary Preferences

Shifts in dietary preferences are a significant driver of the liquid milk-replacers market. The increasing popularity of veganism and vegetarianism in the US has led to a growing segment of the population seeking alternatives to animal-based products. This trend is not only limited to personal dietary choices but also extends to broader lifestyle changes that emphasize ethical consumption. As more consumers adopt plant-based diets, the demand for liquid milk-replacers is expected to rise. Market data suggests that the segment of consumers identifying as vegan has increased by over 300% in recent years, indicating a substantial shift that is likely to continue influencing the liquid milk-replacers market.

Expansion of Distribution Channels

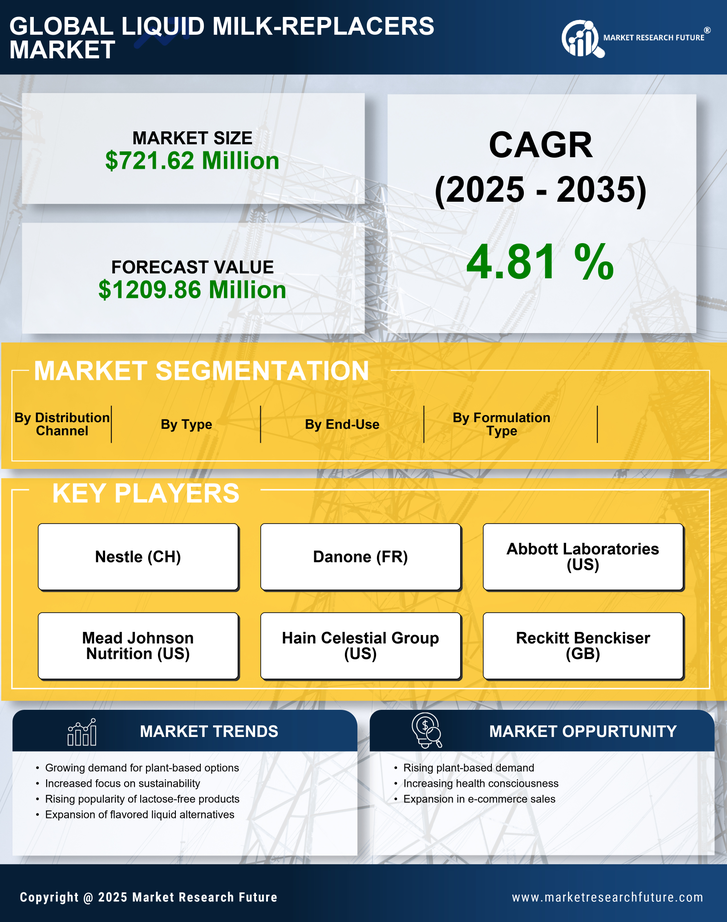

The expansion of distribution channels is enhancing the accessibility of liquid milk-replacers in the US market. Retailers are increasingly recognizing the demand for these products and are expanding their offerings in both physical stores and online platforms. This trend is particularly evident in supermarkets, health food stores, and e-commerce sites, which are now featuring a wider variety of liquid milk-replacers. The convenience of online shopping has also contributed to increased sales, as consumers can easily compare products and make informed choices. As distribution channels continue to grow and diversify, the liquid milk-replacers market is likely to benefit from improved consumer access and heightened visibility.

Innovations in Product Development

Innovations in product development are playing a crucial role in shaping the liquid milk-replacers market. Manufacturers are increasingly investing in research and development to create new formulations that enhance taste, texture, and nutritional value. For instance, the introduction of fortified liquid milk-replacers enriched with vitamins and minerals is appealing to health-conscious consumers. Additionally, advancements in processing technologies are enabling the production of creamier and more palatable alternatives. This focus on innovation is expected to drive market growth, as consumers are more likely to try new products that align with their dietary preferences. The liquid milk-replacers market is thus positioned to benefit from continuous product enhancements that meet evolving consumer demands.

Increasing Demand for Dairy Alternatives

The liquid milk-replacers market is experiencing a notable surge in demand for dairy alternatives, driven by a growing consumer preference for plant-based products. This shift is largely influenced by health-conscious individuals seeking lactose-free options and those with dairy allergies. According to recent data, the market for dairy alternatives in the US is projected to reach approximately $30 billion by 2026, indicating a robust growth trajectory. This trend is further supported by the increasing availability of diverse liquid milk-replacers, such as almond, soy, and oat milk, which cater to various dietary needs. As consumers become more aware of the nutritional benefits associated with these alternatives, the liquid milk-replacers market is likely to expand, reflecting a broader movement towards healthier eating habits.

Rising Awareness of Environmental Impact

Rising awareness of environmental impact is significantly influencing the liquid milk-replacers market. Consumers are increasingly concerned about the ecological footprint of their food choices, leading to a preference for sustainable and eco-friendly products. Liquid milk-replacers, particularly those derived from plants, are often perceived as more sustainable compared to traditional dairy. This perception is supported by studies indicating that plant-based milk production typically requires less water and land, and generates lower greenhouse gas emissions. As a result, the liquid milk-replacers market is likely to see a continued influx of environmentally conscious consumers, further driving demand for plant-based alternatives.