Geopolitical Tensions

Geopolitical tensions continue to shape the Military Transport Aircraft Market, as nations seek to bolster their military capabilities in response to regional conflicts and security threats. The ongoing need for strategic airlift capabilities is underscored by recent military engagements that require rapid troop and equipment deployment. Data indicates that countries in conflict-prone regions are increasing their investments in military transport aircraft to ensure operational readiness. This focus on enhancing air mobility capabilities is likely to result in a competitive landscape, with manufacturers striving to meet the demands of various armed forces. As geopolitical dynamics evolve, the Military Transport Aircraft Market is expected to witness sustained growth.

Technological Innovations

Technological advancements play a crucial role in shaping the Military Transport Aircraft Market. Innovations such as improved fuel efficiency, enhanced cargo capacity, and advanced avionics systems are driving the development of next-generation transport aircraft. For example, the introduction of hybrid-electric propulsion systems is anticipated to reduce operational costs and environmental impact. Furthermore, the integration of unmanned aerial vehicles (UAVs) into transport operations is gaining traction, offering new capabilities for logistics and supply chain management. These technological innovations not only enhance operational effectiveness but also attract investments, thereby stimulating growth in the Military Transport Aircraft Market.

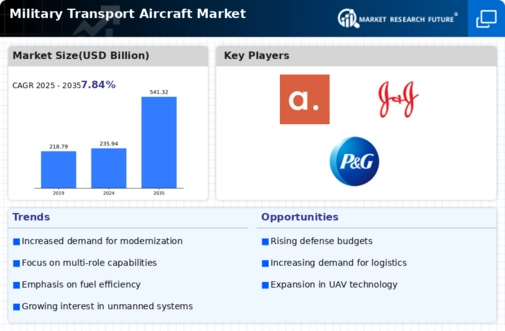

Increasing Defense Budgets

The Military Transport Aircraft Market is experiencing a notable surge in defense budgets across various nations. Governments are prioritizing military modernization, which includes the procurement of advanced transport aircraft. For instance, recent data indicates that defense spending has increased by approximately 3.5% annually, with a significant portion allocated to airlift capabilities. This trend is driven by the need for rapid deployment and logistical support in diverse operational environments. As nations seek to enhance their strategic mobility, investments in military transport aircraft are likely to rise, fostering growth in the market. The emphasis on maintaining operational readiness and responding to emerging threats further propels this demand, suggesting a robust future for the Military Transport Aircraft Market.

Evolving Military Strategies

The Military Transport Aircraft Market is influenced by the evolving nature of military strategies that emphasize rapid response and flexibility. Modern warfare increasingly requires forces to be deployed swiftly across various terrains, necessitating advanced transport solutions. The integration of multi-role capabilities in transport aircraft allows for versatile operations, from troop transport to humanitarian missions. As military doctrines shift towards joint operations and interoperability among allied forces, the demand for specialized transport aircraft is expected to grow. This evolution in military strategy indicates a potential increase in procurement activities, thereby enhancing the market landscape for military transport aircraft.

Rising Humanitarian Missions

The Military Transport Aircraft Market is increasingly influenced by the rising demand for humanitarian missions and disaster relief operations. As natural disasters and humanitarian crises become more frequent, military transport aircraft are often deployed to provide critical support. Recent statistics suggest that military aircraft have been utilized in over 50% of major disaster response efforts in the past year. This trend underscores the importance of having a robust fleet capable of rapid deployment and logistical support in crisis situations. Consequently, the need for versatile and reliable transport aircraft is likely to grow, further driving the Military Transport Aircraft Market.