Research Methodology on Military Simulation Virtual Training Market

Introduction

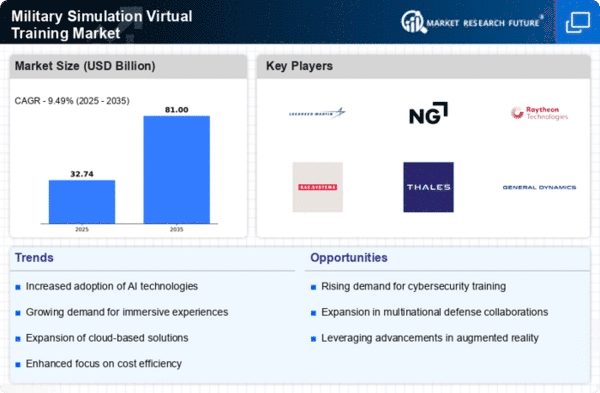

In today's global political arena, military simulation and virtual training play a major role in the development and advancement of the military powers of many nations. This market has witnessed strong traction in the past few years and is expected to register decisive growth in the years to come. Military simulation and virtual training have revolutionized the way the military and defence industry prepares itself for the upcoming challenges.

With the help of modern simulation techniques and systems, the military can train its personnel more efficiently. To comprehend the magnitude of the market, Market Research Future (MRFR) has conducted an extensive analysis of the market and has presented its findings in a report titled “Military Simulation and Virtual Training Market”.

Research Methodology

In order to study the global military simulation and virtual training market and estimate size, growth rate and potential, both primary and secondary research were undertaken. The primary research includes the review, analysis and discussion with the CXOs and leading players in the military simulation and virtual training market.

Secondary research is conducted by studying, analyzing and using the data from numerous internal and external data sources. These include various sources such as websites, research papers, company annual reports/presentations and magazines/journals. In addition, our analysts have used various tools such as Porter’s Five Forces Model, CAGR Calculator and PESTLE Analysis to have an in-depth analysis of the market.

Market segmentation

The global military simulation and virtual training market are segmented based on component, application, platform and region. These segments have been studied carefully and key findings and insights relating to them have been presented in this report.

On the basis of components, the global military simulation and virtual training market are segmented into software, hardware and services. The hardware segment is further sub-segmented into displays, weapons, sensors, controllers, simulators and other hardware components. The services segment can be further sub-segmented into integration and maintenance and other services.

By application, the market has been segmented into vehicle simulation, mission rehearsal, live training, logistics simulation and others.

On the basis of platform, the market is divided into virtual, constructive and immersive.

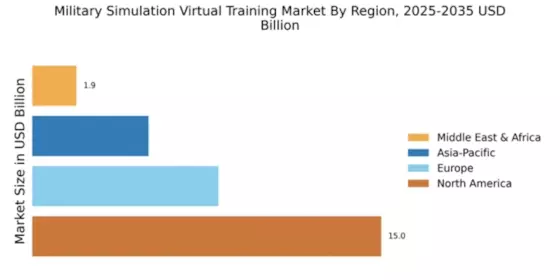

By region, the market is segmented into North America, Europe, Asia-Pacific and the Rest of the World.

Data collection

The data is collected from various primary and secondary sources, such as various industry journals, electronically published materials such as websites and magazines/journals, press releases and also proprietary databases. Secondary sources include financial institutions, market research organizations and other industry sources. In addition, face-to-face interviews with a large number of key opinion leaders in the industry have been conducted to obtain in-depth information about the current market trends and the future prospects of the military simulation and virtual training market.

Data validation

All the collected data is validated through a systematic approach of triangulation to ensure accuracy, reliability and credibility. It includes the validation of primary data collected from various sources and data collected from multiple secondary sources are reconciled to ensure the accuracy of market estimates.

Data analysis

The collected data is analyzed using various quantitative and qualitative techniques such as SWOT analysis and Porter’s Five Forces analysis. It is then studied in detail to understand the market size, share and growth of the global military simulation and virtual training market.

Report Summary

This report gives an in-depth analysis of the military simulation and virtual training market. It provides a detailed segmentation of the market based on component, application, platform and region. The report includes a comprehensive assessment of the key market dynamics, which includes the drivers, restraints, opportunities, trends and challenges. It also highlights the major factors that are influencing the market and presents the expected market outlook for the forecast period 2023 to 2030. The report also provides a comprehensive outlook of the regional market and an in-depth analysis of the key market players.