Emerging Markets

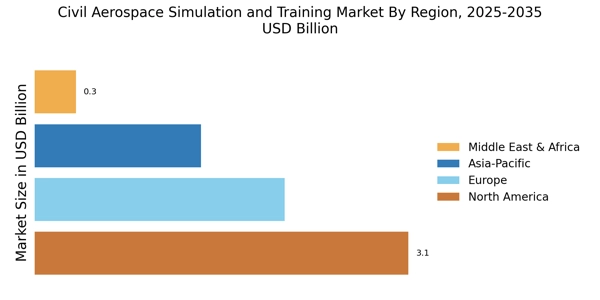

Emerging markets are becoming increasingly influential in the Civil Aerospace Simulation and Training Market. Countries with expanding aviation sectors are investing heavily in training infrastructure to support their growing fleets and increasing air traffic. For instance, regions in Asia and the Middle East are witnessing a rapid rise in air travel demand, prompting governments and private entities to enhance their training capabilities. This trend is reflected in the establishment of new training centers and partnerships with established simulation providers. As these markets develop, they present lucrative opportunities for simulation and training solution providers, potentially leading to a diversification of offerings tailored to meet local needs. The growth of emerging markets is likely to play a crucial role in shaping the future landscape of the Civil Aerospace Simulation and Training Market.

Regulatory Requirements

The Civil Aerospace Simulation and Training Market is significantly influenced by stringent regulatory requirements imposed by aviation authorities worldwide. These regulations mandate that pilots and crew undergo rigorous training and assessment to ensure safety and compliance with operational standards. As regulatory bodies continue to evolve their training requirements, the demand for high-quality simulation and training solutions is expected to rise. For instance, the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) have established comprehensive guidelines that necessitate the use of advanced simulation technologies in pilot training. This regulatory landscape compels training organizations to invest in state-of-the-art simulation systems, thereby propelling growth in the Civil Aerospace Simulation and Training Market.

Focus on Cost Efficiency

Cost efficiency is a pivotal driver in the Civil Aerospace Simulation and Training Market. As airlines and training institutions seek to optimize their operational expenditures, simulation-based training emerges as a cost-effective alternative to traditional flight training methods. Simulators reduce the need for actual flight hours, which can be prohibitively expensive, especially for new pilots. Moreover, the ability to conduct multiple training scenarios in a controlled environment minimizes the risks associated with in-flight training. Recent analyses indicate that organizations utilizing simulation training can achieve significant savings while maintaining high training standards. This focus on cost efficiency is likely to encourage further investment in simulation technologies, thereby fostering growth in the Civil Aerospace Simulation and Training Market.

Technological Advancements

The Civil Aerospace Simulation and Training Market is experiencing a surge in technological advancements, particularly in virtual reality (VR) and augmented reality (AR). These technologies enhance the realism of training environments, allowing pilots and crew to engage in immersive simulations that closely mimic real-world scenarios. The integration of artificial intelligence (AI) into training programs is also noteworthy, as it personalizes learning experiences and improves training outcomes. According to recent data, the market for VR and AR in aviation training is projected to grow significantly, indicating a shift towards more sophisticated training methodologies. This evolution in technology not only enhances the effectiveness of training but also reduces costs associated with traditional training methods, thereby driving growth in the Civil Aerospace Simulation and Training Market.

Increasing Demand for Skilled Workforce

The Civil Aerospace Simulation and Training Market is driven by the increasing demand for a skilled workforce in the aviation sector. As air travel continues to expand, airlines and training organizations are under pressure to ensure that their personnel are adequately trained to meet safety and operational standards. The International Air Transport Association (IATA) forecasts a substantial increase in air traffic, necessitating the training of thousands of new pilots and crew members. This demand creates a robust market for simulation and training solutions, as they provide efficient and effective means to prepare individuals for the complexities of modern aviation. Consequently, the Civil Aerospace Simulation and Training Market is likely to see sustained growth as organizations invest in advanced training technologies to cultivate a competent workforce.