Research Methodology on Search and Rescue Robots Market

Introduction

The purpose of this research is to provide an updated and comprehensive overview of the current state of the global search and rescue robot market. Market research future has conducted this study to cover the overall dynamics and trends pertaining to the search and rescue robot market regarding market segments, dynamics, and technologies around the world.

Objectives

The main objectives of this research report are:

- To provide an efficient and comprehensive overview of the global search and rescue robot market

- To analyze and estimate the current market size and expected growth of the market till 2030

- To identify potential industry players, emerging technologies, and key trends and dynamics in the market

- To examine the impact of various factors such as market drivers, challenges, trends, and other factors on the growth of the search and rescue robot market

- To provide an analysis of the market based on past research and to identify potential key regions, prominent market players, and necessary strategies to gain an edge in the market

Scope of Study

This research is focused on the global search and rescue robot market and analyzes the growth and trends of the market from 2024 to 2030. The report looks into key regions around the world and profiles the leading companies associated with the search and rescue robot market.

Research Methodology

This report is compiled using a combination of primary and secondary research. The primary research methodology is based on primary interviews with industry experts and is supplemented with extensive secondary sources of research. Furthermore, the research is composed of credible sources such as the World Bank, the Ministry of Economy and Industry, the China National Institute of Statistics, and The Global Wind Energy Chicago Council on Global Affairs. To supplement the secondary research, primary research in the form of interviews and surveys has been conducted.

Secondary Research

Secondary research is an extensive process of obtaining information from existing publications. The data and analysis related to the search and rescue robot market are collected from credible sources such as industry magazines and journals, white papers, annual reports, newspapers, press releases, and various industry portals. The research approach includes establishing the information sources and studying the renowned research databases. The team also contacted industry experts and obtained the data and details from seminars, conferences, and presentations in related magazines, websites, and industry associations.

Primary Research

Primary research or interviews were conducted to gain a deeper insight into the search and rescue robot market. The team interviewed leading industry experts and consulted with knowledgeable stakeholders. The primary research is conducted to obtain comprehensive insights related to the market and research reports. Interviews were conducted with industry experts and experts from the industry to obtain relevant and reliable information.

Statistical Analysis

The statistical analysis used in the research report includes graphical and tabular representations of the data gathered. This is used to obtain a better understanding and to give a visual representation of the market trends. The graphical representation of the data is used to generate further insights into the market.

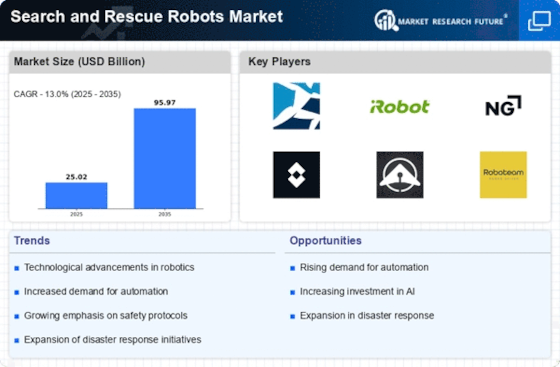

Global Search and Rescue Robot Market Analysis

The research report covers the global search and rescue robot market in detail and provides a comprehensive overview of the drivers, opportunities, trends and market dynamics.

Market Segmentation

The report segments the global search and rescue robot market by application, end-use industry, and region.

By Application

- Unmanned Aerial Vehicles

- Unmanned Underwater Vehicles

- Unmanned Ground Vehicles

By End-Use Industry

- Military & Security

- Transportation & Logistics

- Healthcare

- Mining

- Others

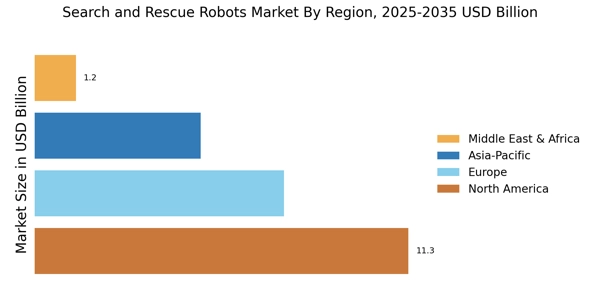

By Region

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

Competitive Landscape

The competitive landscape section of this report profiles the leading companies in the search and rescue robot market and provides an analysis of their key strategies, such as product developments, partnerships, alliances, acquisitions, expansions, and other strategic developments.

Conclusion

The study provides a comprehensive overview of the market and identifies key players, market dynamics, and potential opportunities in the global search and rescue robot market. The report provides a detailed and segmented analysis of the global search and rescue robot market and also provides insights into the regional variations of the market. The research report also provides an in-depth analysis of the leading companies operating in the market.