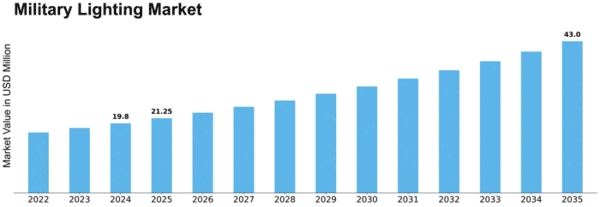

Military Lighting Size

Military Lighting Market Growth Projections and Opportunities

The military lighting market is influenced by several key factors that shape its growth and development. Military lighting plays a crucial role in enhancing visibility, safety, and operational effectiveness in various military applications, including tactical operations, base camps, vehicles, and aircraft. One of the primary drivers of the military lighting market is the increasing demand for advanced lighting solutions to support military operations in diverse and challenging environments. As military forces operate in different lighting conditions, including low-light, nighttime, and adverse weather conditions, there's a growing need for lighting systems that provide reliable illumination to enhance situational awareness and facilitate mission success.

Moreover, advancements in lighting technology, including developments in LED (Light Emitting Diode) technology, thermal management, and ruggedization, have led to innovations in military lighting systems, driving further adoption across military organizations worldwide. LED lighting offers advantages such as energy efficiency, long lifespan, durability, and resistance to shock, vibration, and harsh environmental conditions, making it ideal for military applications. New generations of military lighting systems incorporate advanced features such as variable intensity, adjustable color temperature, and remote control capabilities, enabling soldiers to customize lighting settings based on mission requirements and operational needs.

Furthermore, the growing trend towards expeditionary and mobile military operations is driving investment and innovation in deployable lighting solutions. Military forces require lighting systems that are portable, compact, and easy to deploy in remote or temporary locations, such as forward operating bases, field hospitals, and disaster relief operations. Deployable lighting systems such as portable floodlights, area lighting systems, and tent lighting kits enable soldiers to establish temporary lighting infrastructure quickly and efficiently, enhancing safety, security, and operational effectiveness in the field. This creates opportunities for lighting manufacturers to develop lightweight, durable, and energy-efficient lighting solutions tailored to the needs of expeditionary military forces.

Additionally, the increasing emphasis on energy efficiency, sustainability, and cost-effectiveness in military operations is driving demand for LED lighting systems that offer reduced power consumption, lower maintenance requirements, and longer operational lifespan compared to traditional lighting technologies. LED lighting not only reduces energy consumption and operating costs but also minimizes logistical burden and environmental footprint by requiring fewer replacements and reducing waste. This drives adoption of LED lighting systems across military installations, vehicles, and platforms, enabling military organizations to achieve energy savings, improve operational efficiency, and meet sustainability goals while enhancing lighting performance and reliability.

Moreover, the growing demand for advanced lighting solutions in military vehicles, aircraft, and naval vessels is driving growth in the military lighting market. Military vehicles require lighting systems that provide effective illumination for navigation, communication, and situational awareness in both on-road and off-road conditions. Aircraft lighting systems play a critical role in cockpit lighting, instrument illumination, and exterior lighting for navigation and visibility during flight operations. Naval vessels require lighting systems that are waterproof, corrosion-resistant, and capable of withstanding harsh marine environments. This drives demand for ruggedized lighting solutions that meet military specifications and performance requirements for use in land, air, and maritime platforms.

Leave a Comment