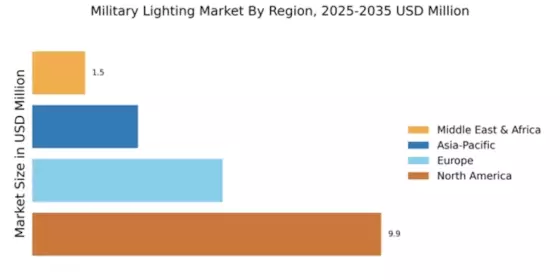

North America : Market Leader in Military Lighting

North America continues to lead the Military Lighting Market, holding a significant share of 9.9 in 2024. The region's growth is driven by increasing defense budgets, technological advancements, and a focus on enhancing operational capabilities. Regulatory support for military modernization and energy-efficient solutions further fuels demand, making it a pivotal market for military lighting solutions.

The competitive landscape is characterized by major players such as General Dynamics, Northrop Grumman, and Raytheon Technologies, which are at the forefront of innovation. The U.S. military's emphasis on advanced lighting systems for tactical operations and training exercises underscores the importance of this market. With a robust supply chain and R&D investments, North America is poised for sustained growth in military lighting.

Europe : Emerging Market with Growth Potential

Europe's Military Lighting Market is valued at 5.4, reflecting a growing emphasis on defense capabilities and modernization. The region is witnessing increased investments in military infrastructure, driven by geopolitical tensions and the need for enhanced operational readiness. Regulatory frameworks promoting energy-efficient technologies are also contributing to market growth, as nations seek to optimize defense spending.

Leading countries like the UK, France, and Germany are key players in this market, with companies such as Thales Group and BAE Systems driving innovation. The competitive landscape is evolving, with a focus on collaborative defense initiatives and partnerships. As European nations prioritize military readiness, the demand for advanced lighting solutions is expected to rise significantly.

Asia-Pacific : Rapidly Growing Defense Sector

The Asia-Pacific Military Lighting Market, valued at 3.0, is experiencing rapid growth due to increasing defense expenditures and modernization efforts across the region. Countries like India, China, and Japan are investing heavily in advanced military technologies, including lighting systems. The demand for energy-efficient and durable lighting solutions is rising, driven by the need for enhanced operational capabilities in diverse environments.

The competitive landscape features key players such as Elbit Systems and L3Harris Technologies, which are expanding their presence in the region. As nations focus on strengthening their military capabilities, the market for military lighting is expected to see significant advancements and innovations, catering to the unique needs of the region's armed forces.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa Military Lighting Market, valued at 1.5, is emerging as a significant player in the global landscape. The region's growth is driven by increasing military spending and the need for advanced lighting solutions in combat and training scenarios. Regulatory support for defense modernization initiatives is also a key factor, as countries seek to enhance their military capabilities in response to regional conflicts.

Leading countries such as the UAE and South Africa are investing in military infrastructure, with a focus on innovative lighting technologies. The competitive landscape is characterized by a mix of local and international players, striving to meet the unique demands of the region. As military operations evolve, the demand for reliable and efficient lighting solutions is expected to grow steadily.