Top Industry Leaders in the Military Drone Market

Strategies Adopted: To secure a foothold in the fiercely competitive Military Drone market, key players adopt strategic approaches. A significant focus is on continuous research and development (R&D) investments to enhance drone capabilities, ranging from intelligence, surveillance, and reconnaissance (ISR) to strike capabilities. Strategic collaborations and partnerships, often formed with government agencies and allied nations, facilitate the integration of cutting-edge technologies and ensure compliance with evolving military requirements. Global market expansion through international sales, alliances, and the establishment of production and service facilities in key regions are key strategies, allowing companies to cater to the diverse needs of military forces worldwide.

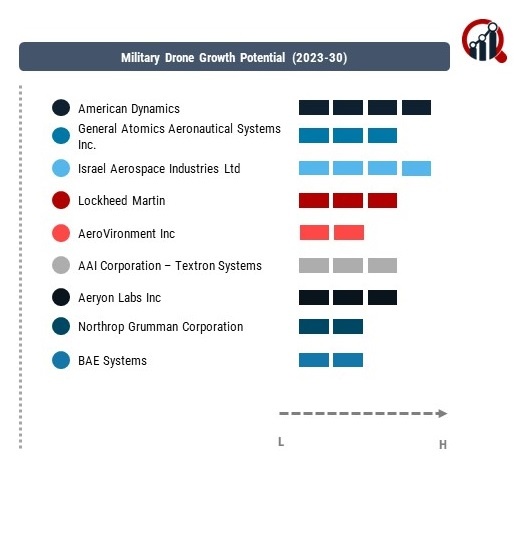

Competitive Landscape of Military Drone Market

Key Companies in the Military Drone market include.

- American Dynamics (U.S.)

- General Atomics Aeronautical Systems Inc. (U.S.)

- Israel Aerospace Industries Ltd (Israel)

- Lockheed Martin (U.S.)

- AeroVironment Inc (U.S.)

- AAI Corporation – Textron Systems (U.S.)

- Aeryon Labs Inc (Canada)

- Northrop Grumman Corporation (U.S.)

- BAE Systems (U.K.)

- Boeing (U.S.)

Factors for Market Share Analysis: Market share analysis in the Military Drone market is influenced by various factors. Technical capabilities, such as range, endurance, payload capacity, and stealth features, are critical considerations for military customers. Companies offering a diverse portfolio of drone systems tailored to different mission requirements, from surveillance to strike capabilities, are better positioned to capture a larger market share. Compliance with stringent military standards and regulations, interoperability with existing military systems, and adaptability to emerging threats contribute significantly to market share dynamics. Additionally, factors like the ability to provide comprehensive training, maintenance, and support services further enhance a company's competitive standing.

New and Emerging Companies: While established players dominate the market, new and emerging companies bring innovation and agility, contributing to the evolution of military drone capabilities. Companies like AeroVironment, Inc., and Turkish Aerospace Industries (TAI) are gaining recognition for their specialized drone solutions, often focusing on niche segments or introducing novel technologies. These emerging companies frequently leverage advancements in artificial intelligence, autonomy, and miniaturized drone technologies, contributing to the diversity and adaptability of the Military Drone market.

Industry News: Recent industry news in the Military Drone market highlights ongoing developments and trends shaping the sector. Innovations in swarm drone technologies, artificial intelligence-driven mission planning, and enhanced communication and connectivity features are gaining prominence. News often covers advancements in vertical takeoff and landing (VTOL) drone capabilities, expanding the operational scope for military forces. Additionally, developments in counter-drone technologies and anti-drone systems underscore the dynamic nature of the market, with continuous efforts to address emerging threats and challenges. Industry news reflects the evolution of military drone capabilities and the industry's response to changing security landscapes.

Current Company Investment Trends: Investment trends in the Military Drone market underscore a commitment to technological advancements, autonomy, and adaptability. Companies are allocating substantial resources to R&D initiatives focused on artificial intelligence, machine learning, and autonomous navigation to enhance drone capabilities. Investments in swarming technologies, enabling multiple drones to operate collaboratively, are gaining traction. Strategic acquisitions of technology startups and partnerships with research institutions contribute to a holistic approach, ensuring a continuous stream of cutting-edge solutions and maintaining a competitive edge in the market.

Overall Competitive Scenario: The overall competitive scenario in the Military Drone market reflects a balance between established industry leaders and emerging companies that bring innovation and flexibility to the sector. Established defense contractors leverage their extensive experience, global reach, and comprehensive drone portfolios to set industry standards. Simultaneously, emerging companies contribute to the diversification of drone capabilities, often focusing on specific applications or introducing disruptive technologies. The industry's response to evolving military requirements, technological advancements, and emerging threats highlights the adaptability and resilience of Military Drone providers. As military forces globally seek more advanced and versatile unmanned systems, the Military Drone market is poised for continued evolution. The emphasis on technological advancements, strategic collaborations, and meeting the dynamic needs of modern warfare positions this market as a critical enabler for military capabilities in surveillance, reconnaissance, and strategic operations.

Recent Development:

March 2022: Gambit, an Autonomous Collaborative Platform (ACP) designed through digital engineering, was revealed. The jet-powered platform is being built for air dominance and will heavily leverage advances in artificial intelligence and autonomous systems. The design aims to speed up time to market and lower acquisition costs.Top of Form

December 2021: The Mojave, an unmanned aerial vehicle (UAV) capable of short takeoff and landing (STOL), was introduced. It utilizes a Gray Eagle fuselage, enlarged wings with high-lift devices, and a Rolls Royce 450-horsepower turboprop engine. The UAS is based on the avionics and flight control systems of the MQ-9 Reaper and the MQ-1C Gray Eagle- Extended Range.

October 2021: Teledyne FLIR Defense, a part of Teledyne FLIR LLC, launched the ION M640x tactical Unmanned Aerial System (UAS). Building on the capabilities of the ION M440, this UAS provides military and other government customers with best-in-class capabilities for their unique missions.

March 2021: The Boeing MQ-28 Ghost Bat, previously known as the Boeing Airpower Teaming System (ATS) and the Loyal Wingman project, successfully completed its first test flight.

January 2021: Long Runner, a strategic UAV controlled by satellite communication with precise automated take-off and landing (ATOL) capability, was introduced. This innovative feature eliminates the need for a ground control station and flight crew at the aircraft's forward base.