North America : Market Leader in Defense Services

North America holds a commanding 40.0% share of the Military Aircraft Maintenance and Overhaul Services Market, driven by robust defense budgets and a focus on modernization. The region's growth is fueled by increasing geopolitical tensions and the need for advanced military capabilities. Regulatory support from government initiatives further enhances market dynamics, ensuring compliance and safety in military operations.

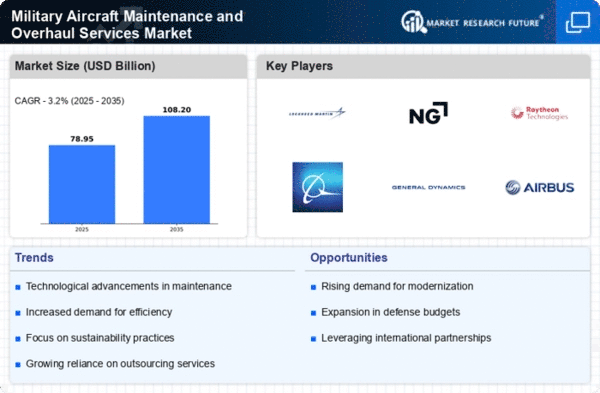

The United States is the primary player, hosting major defense contractors like Lockheed Martin, Boeing, and Northrop Grumman. These companies lead in innovation and service delivery, contributing significantly to the market's expansion. The competitive landscape is characterized by strategic partnerships and technological advancements, ensuring that North America remains at the forefront of military aircraft maintenance services.

Europe : Growing Demand for Defense Services

Europe's Military Aircraft Maintenance and Overhaul Services Market is valued at 20.0%, reflecting a growing emphasis on defense readiness and modernization. The region is witnessing increased investments in military capabilities, driven by rising security concerns and collaborative defense initiatives among EU nations. Regulatory frameworks are evolving to support these advancements, ensuring compliance with NATO standards and enhancing operational efficiency.

Leading countries such as the UK, France, and Germany are pivotal in this market, with key players like Airbus and BAE Systems driving innovation. The competitive landscape is marked by partnerships and joint ventures aimed at enhancing service offerings. As European nations prioritize defense spending, the market is expected to grow, fostering a robust environment for military aircraft maintenance services.

Asia-Pacific : Emerging Market for Defense Services

The Asia-Pacific region, with a market size of 12.0%, is rapidly emerging in the Military Aircraft Maintenance and Overhaul Services sector. This growth is driven by increasing defense budgets, regional tensions, and a focus on indigenous military capabilities. Countries are investing heavily in modernization and technological advancements, supported by government initiatives aimed at enhancing defense readiness and operational efficiency.

Key players in this region include Hindustan Aeronautics Limited and various local firms, with countries like India and Japan leading the charge. The competitive landscape is evolving, with collaborations and partnerships becoming more common as nations seek to bolster their military capabilities. As the demand for maintenance services grows, the Asia-Pacific market is poised for significant expansion.

Middle East and Africa : Strategic Growth in Defense Sector

The Middle East and Africa region, with a market size of 4.5%, is witnessing strategic growth in Military Aircraft Maintenance and Overhaul Services. This growth is driven by increasing defense expenditures and geopolitical instability, prompting nations to enhance their military capabilities. Regulatory frameworks are being established to support modernization efforts and ensure compliance with international standards, fostering a conducive environment for market expansion.

Countries like the UAE and South Africa are at the forefront, with local and international players vying for market share. The competitive landscape is characterized by partnerships and collaborations aimed at improving service delivery and technological advancements. As regional tensions persist, the demand for military maintenance services is expected to rise, positioning the Middle East and Africa as a key player in the global market.