North America : Market Leader in MRO Solutions

North America is poised to maintain its leadership in the Aircraft Maintenance, Repair, and Overhaul (MRO) IT Solutions market, holding a significant market share of 3.25 billion. The region's growth is driven by increasing air traffic, stringent safety regulations, and advancements in technology. The demand for efficient maintenance solutions is further fueled by the rising operational costs of airlines, pushing them to adopt innovative IT solutions for MRO processes.

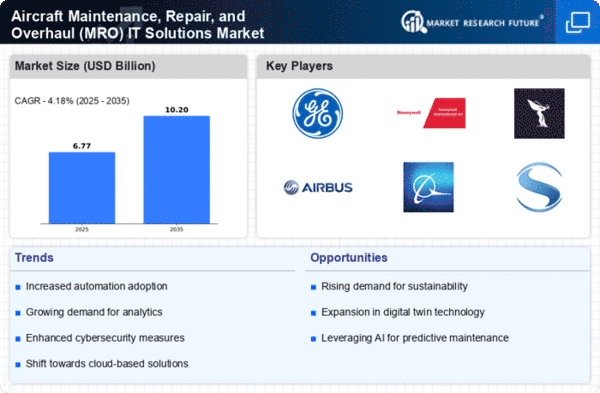

The competitive landscape in North America is robust, featuring key players such as General Electric, Honeywell International, and Boeing. These companies are investing heavily in R&D to enhance their service offerings. The presence of a well-established aviation infrastructure and a high number of aircraft in operation contribute to the region's dominance. As airlines seek to optimize their maintenance operations, the demand for advanced MRO IT solutions is expected to grow significantly.

Europe : Emerging MRO IT Hub

Europe is witnessing a growing demand for Aircraft Maintenance, Repair, and Overhaul (MRO) IT Solutions, with a market size of €1.8 billion. The region benefits from a strong regulatory framework that emphasizes safety and efficiency in aviation operations. Increasing air travel and the need for compliance with stringent EU regulations are key drivers of market growth. Additionally, the push for digital transformation in aviation is catalyzing the adoption of advanced MRO IT solutions across the continent.

Leading countries in this region include Germany, France, and the UK, where major players like Airbus and Rolls-Royce are headquartered. The competitive landscape is characterized by a mix of established firms and innovative startups, all vying for market share. The European MRO market is expected to expand as companies invest in new technologies to enhance operational efficiency and reduce costs. "The European aviation sector is committed to maintaining the highest safety standards while embracing innovation to improve MRO processes," European Aviation Safety Agency.

Asia-Pacific : Rapidly Growing MRO Sector

The Asia-Pacific region is emerging as a significant player in the Aircraft Maintenance, Repair, and Overhaul (MRO) IT Solutions market, with a market size of $1.5 billion. The growth is driven by increasing air travel demand, rising disposable incomes, and the expansion of low-cost carriers. Governments in the region are also investing in aviation infrastructure, which is expected to further boost the MRO sector. Regulatory support for modernization and safety improvements is enhancing the appeal of MRO IT solutions.

Countries like China, India, and Japan are leading the charge in this market. The competitive landscape features both global giants and local players, with companies like Boeing and Thales Group actively participating. As the region's aviation market continues to grow, the demand for advanced MRO IT solutions is anticipated to rise, driven by the need for efficiency and cost-effectiveness in maintenance operations.

Middle East and Africa : Emerging MRO Opportunities

The Middle East and Africa region is gradually developing its Aircraft Maintenance, Repair, and Overhaul (MRO) IT Solutions market, currently valued at $0.95 billion. The growth is fueled by increasing air traffic and investments in aviation infrastructure. The region's strategic location as a global aviation hub enhances its appeal for MRO services. Additionally, regulatory frameworks are evolving to support modernization and safety in aviation operations, which is expected to drive demand for MRO IT solutions.

Countries like the UAE and South Africa are at the forefront of this market, with several key players establishing operations in the region. The competitive landscape is characterized by a mix of local and international firms, all aiming to capture the growing demand for MRO services. As airlines in the region seek to enhance operational efficiency, the adoption of advanced MRO IT solutions is likely to increase significantly.