Market Analysis

In-depth Analysis of Military Aircraft Digital Glass Cockpit Systems Market Industry Landscape

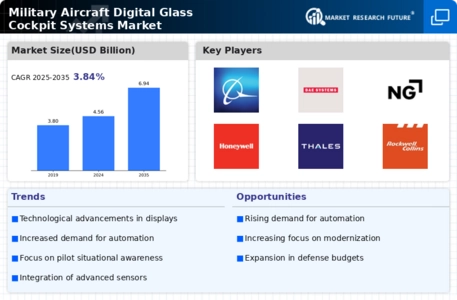

The Military Aircraft Digital Glass Cockpit Systems market operates within a dynamic landscape shaped by various factors influencing its growth and evolution. One of the primary drivers of this market is the increasing need for advanced avionics solutions in military aircraft. As defense forces worldwide seek to enhance situational awareness, reduce pilot workload, and improve overall mission effectiveness, the demand for digital glass cockpit systems rises. These systems, characterized by large electronic displays and integrated avionics, provide pilots with real-time, customizable information, contributing to enhanced operational capabilities.

Technological advancements play a crucial role in shaping the market dynamics of military aircraft digital glass cockpit systems. As aerospace technology evolves, digital glass cockpit systems undergo continuous innovation to incorporate the latest avionics capabilities. The integration of touchscreens, head-up displays, and advanced navigation features enhances the functionality of these systems, providing military pilots with intuitive and user-friendly interfaces. The constant pursuit of technological excellence by manufacturers and suppliers drives market growth as defense organizations seek cutting-edge avionics solutions to maintain a technological edge.

The regulatory environment and defense standards significantly influence the military aircraft digital glass cockpit systems market. Governments and defense agencies establish stringent certification requirements to ensure the safety and reliability of avionics systems. Compliance with these standards is imperative for market participants, influencing system design, development, and integration. The adherence to military specifications ensures that digital glass cockpit systems meet the rigorous demands of military operations, influencing market dynamics by fostering trust in the reliability and performance of these systems.

The competitive landscape within the military aircraft digital glass cockpit systems market is characterized by the presence of major aerospace and defense companies alongside specialized avionics manufacturers. Intense competition drives continuous innovation, with companies vying to offer solutions that provide superior performance, flexibility, and compatibility with diverse military aircraft platforms. Collaboration and partnerships between original equipment manufacturers (OEMs) and avionics suppliers contribute to market dynamics, enabling the delivery of integrated and efficient cockpit solutions.

Global geopolitical factors significantly impact the military aircraft digital glass cockpit systems market. Defense budget allocations, strategic modernization initiatives, and geopolitical tensions influence procurement decisions by military forces. Periods of increased defense spending and the introduction of new military aircraft programs drive demand for advanced avionics systems, contributing to market growth. Conversely, budget constraints or shifts in defense priorities may impact procurement timelines and influence the overall market outlook.

The market is further influenced by the growing emphasis on interoperability and connectivity in military operations. Digital glass cockpit systems that can seamlessly integrate with other avionics platforms and communication networks enhance the effectiveness of joint and coalition missions. As military forces adopt network-centric warfare strategies, the demand for interconnected and interoperable digital glass cockpit systems rises, influencing market dynamics and driving the development of integrated solutions.

Environmental sustainability considerations are gradually becoming relevant in the military aircraft digital glass cockpit systems market. While environmental concerns are not the primary focus in military aviation, advancements in avionics technologies are increasingly incorporating energy-efficient designs and materials. The pursuit of sustainability aligns with broader global efforts to reduce the environmental impact of aviation, creating opportunities for market players to contribute to more eco-friendly cockpit solutions.

Leave a Comment