Top Industry Leaders in the Military Aerospace Sensors Market

Military And Aerospace Sensors Market

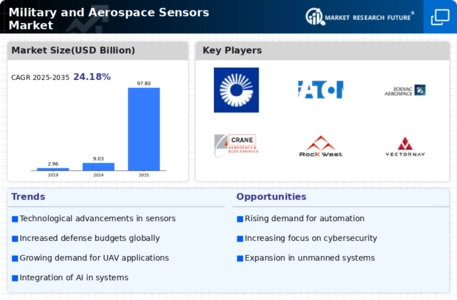

The competitive landscape of the Military and Aerospace Sensors Market is dynamic and evolving, driven by technological advancements, geopolitical factors, and the increasing demand for advanced defense systems. This sector plays a critical role in ensuring national security, and as a result, companies are continuously innovating to stay ahead in this competitive market.

Key Players and Market Share Analysis:

Strategies Adopted by Key Players: To maintain a competitive advantage, key players in the Military and Aerospace Sensors Market adopt various strategies. Investment in research and development is a common approach, as it allows companies to innovate and introduce cutting-edge sensor technologies. Additionally, strategic partnerships, collaborations, and mergers and acquisitions help companies expand their product portfolios and strengthen their market presence. Lockheed Martin, for example, focuses on strategic partnerships with other industry leaders to enhance its capabilities and broaden its market reach.

Moreover, a focus on customization and flexibility in sensor solutions enables companies to cater to diverse customer requirements. Thales Group, known for its adaptive approach, tailors its sensor technologies to meet the specific needs of different defense applications, thereby gaining a competitive advantage.

Factors Influencing Market Share Analysis: Several factors contribute to the analysis of market share in the Military and Aerospace Sensors Market. Technological innovation is a key determinant, as companies investing in state-of-the-art sensor technologies often gain a competitive edge. The ability to provide comprehensive solutions, including data integration and analytics, also plays a crucial role in market share dynamics. Companies that offer end-to-end solutions and effectively address cybersecurity concerns are likely to secure a larger market share.

Geopolitical factors and strategic alliances impact market share, especially for companies that actively participate in international collaborations. Furthermore, the ability to navigate complex regulatory environments and secure government contracts significantly influences a company's market position.

New and Emerging Companies: The Military and Aerospace Sensors Market also witnesses the entry of new and emerging companies, challenging established players. Smaller companies often focus on niche technologies, aiming to address specific defense requirements. AeroVironment, for instance, is gaining traction with its unmanned aircraft systems and associated sensor technologies. These emerging players introduce fresh perspectives and innovative solutions, contributing to the overall competitiveness of the market.

The emergence of startups specializing in artificial intelligence, machine learning, and quantum technologies is reshaping the landscape. These companies bring disruptive capabilities, challenging traditional sensor paradigms and fostering increased competition.

Industry News and Current Company Investment Trends: Ongoing developments and industry news shape the competitive landscape of the Military and Aerospace Sensors Market. The integration of artificial intelligence and machine learning algorithms into sensor systems is a notable trend. Companies are investing heavily in AI to enhance sensor capabilities, enabling real-time data analysis and decision-making.

Furthermore, advancements in miniaturization and the development of lightweight sensors are gaining attention. These trends reflect the industry's focus on improving mobility and reducing the overall weight of military and aerospace systems.

Investment trends reveal a growing emphasis on cybersecurity solutions to protect sensor networks from cyber threats. With the increasing connectivity of military systems, securing data and communications has become a top priority for both established players and new entrants.

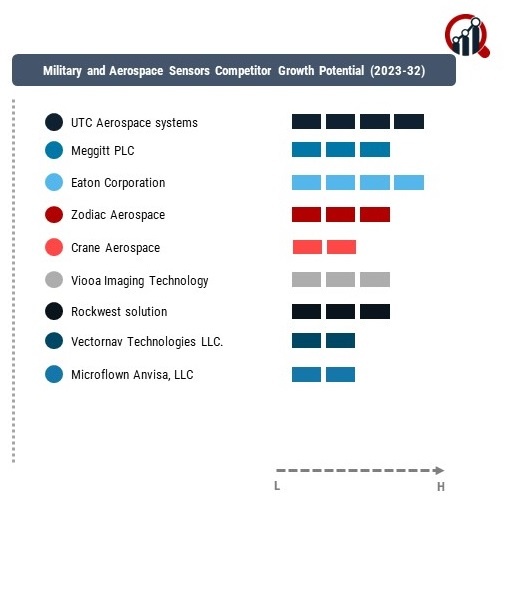

Overall Competitive Scenario: The overall competitive scenario in the Military and Aerospace Sensors Market is characterized by intense rivalry among key players, constant technological advancements, and a diverse range of applications. The market is poised for growth due to increasing defense budgets worldwide, with nations prioritizing the modernization of their military capabilities.

Strategic collaborations, continuous innovation, and a proactive approach to addressing emerging challenges are crucial for companies aiming to thrive in this competitive landscape. The ability to provide integrated sensor solutions, ensure cybersecurity, and adapt to evolving geopolitical dynamics will determine the long-term success of players in the Military and Aerospace Sensors Market.

the Military and Aerospace Sensors Market presents a multifaceted landscape shaped by established industry leaders, new entrants, and technological advancements. The strategies adopted by key players, factors influencing market share, and emerging trends collectively contribute to the competitive dynamics of this vital sector, where innovation and adaptability are key to long-term success.

Recent News :

Market share analysis is influenced by factors such as technological expertise, product portfolio diversity, and global reach. Raytheon Technologies, formed through the merger of Raytheon and United Technologies Corporation, leverages its comprehensive capabilities to offer advanced sensor solutions, giving it a competitive edge. Similarly, Northrop Grumman's expertise in aerospace and defense technologies enables the company to maintain a significant market share.

Contracts and Developments:

Raytheon Technologies (RTX): Secured a USD 117.5 million contract from the US Army for low-rate initial production of 3rd Generation Forward Looking Infrared (3GEN FLIR) B-Kit sensors for ground combat vehicles. (June 2023)

Leonardo DRS (DRS): Awarded a USD 39.5 million contract by the US Army to supply advanced infrared sensors for next-generation sighting systems. (December 2022)

Northrop Grumman Corporation: Integrated and tested the new ultra-wideband Electronically-Scanned Multifunction Reconfigurable Integrated Sensor (EMRIS) for enhanced decision-making capabilities across platforms like aircraft. (February 2023)

Lockheed Martin: Unveiled a new high-resolution electro-optical and infrared (EO/IR) sensor system for enhanced situational awareness and targeting on fighter jets. (October 2023)

Honeywell International Inc.: Received funding from DARPA to develop next-generation inertial sensor technology for military and commercial navigation applications. (January 2021)

Partnerships and Collaborations:

BAE Systems and Leonardo: Partnered to develop a new laser warning system for military aircraft, enhancing survivability against directed-energy threats. (September 2023)

Teledyne Controls and Boeing: Collaborated on integrating Teledyne's advanced Aircraft Cabin Environment Sensor (ACES) on Boeing 737 aircraft, improving air quality monitoring. (March 2021)

Collins Aerospace and Airbus SE: Partnered to integrate next-generation sensors on Airbus aircraft, improving both visibility and fuel efficiency. (August 2021)