Increased Focus on Sustainability

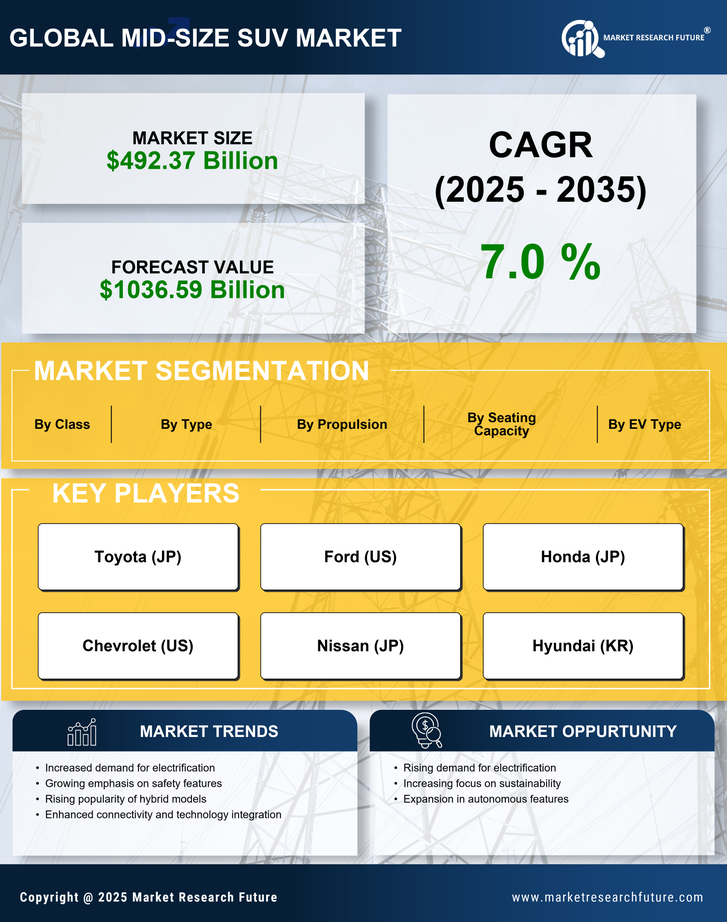

Sustainability is emerging as a crucial driver in the Mid-Size SUV Market, as consumers become more environmentally conscious. Manufacturers are responding by adopting sustainable practices in production and sourcing materials. The use of recycled materials and the development of electric and hybrid models are becoming more prevalent. Data indicates that the market for electric SUVs is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 25% in the next five years. This focus on sustainability not only meets consumer demand but also aligns with regulatory pressures aimed at reducing carbon emissions. As sustainability becomes a core value for many consumers, it is likely to shape the future landscape of the Mid-Size SUV Market.

Rising Demand for Fuel Efficiency

The Mid-Size SUV Market is witnessing a significant shift towards fuel efficiency, driven by rising fuel prices and increasing environmental awareness among consumers. As fuel economy becomes a priority, manufacturers are focusing on developing mid-size SUVs that offer better mileage without compromising performance. Recent statistics indicate that the average fuel economy of new SUVs has improved by approximately 20% over the past five years. This trend is further supported by the introduction of hybrid and electric variants, which appeal to eco-conscious consumers. The demand for fuel-efficient vehicles is expected to continue growing, influencing manufacturers to innovate and adapt their offerings in the Mid-Size SUV Market.

Growing Consumer Preference for SUVs

The Mid-Size SUV Market is experiencing a notable shift in consumer preferences, with an increasing number of buyers gravitating towards SUVs over sedans. This trend is driven by the perception of SUVs as more versatile vehicles, offering a blend of space, comfort, and capability. According to recent data, the SUV segment has captured approximately 45% of the total vehicle market share, indicating a robust demand. This preference is further fueled by lifestyle changes, where families and individuals seek vehicles that accommodate both daily commutes and recreational activities. As a result, manufacturers are responding by expanding their mid-size SUV offerings, enhancing features to meet consumer expectations. This growing inclination towards SUVs is likely to sustain the momentum of the Mid-Size SUV Market in the coming years.

Expanding Urbanization and Lifestyle Changes

Urbanization is a key factor influencing the Mid-Size SUV Market, as more individuals and families move to urban areas. This demographic shift is leading to changes in lifestyle, with consumers seeking vehicles that offer both practicality and style. Mid-size SUVs are increasingly viewed as ideal for urban living, providing ample space for passengers and cargo while remaining manageable in city environments. Recent data shows that urban areas are witnessing a rise in SUV registrations, with mid-size models being particularly popular among city dwellers. As urbanization continues to expand, the demand for mid-size SUVs is expected to grow, further driving the evolution of the Mid-Size SUV Market.

Technological Advancements in Vehicle Design

Technological innovations are playing a pivotal role in shaping the Mid-Size SUV Market. Manufacturers are increasingly integrating advanced technologies into their vehicles, enhancing performance, safety, and user experience. Features such as adaptive cruise control, lane-keeping assist, and advanced driver-assistance systems are becoming standard in many mid-size SUVs. Furthermore, the incorporation of lightweight materials and improved aerodynamics is contributing to better fuel efficiency, which is a critical consideration for consumers. Data suggests that vehicles equipped with these technologies can achieve up to 30% better fuel economy compared to older models. As these advancements continue to evolve, they are likely to attract a broader audience, thereby propelling the growth of the Mid-Size SUV Market.