Emergence of New Market Players

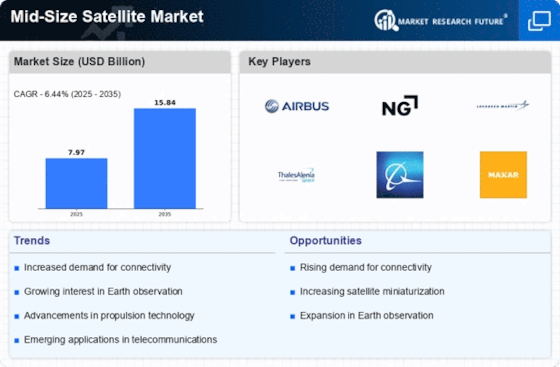

The mid-size satellite Market is experiencing a shift with the emergence of new market players. Startups and established companies are increasingly entering the satellite manufacturing and launch sectors, driven by advancements in technology and decreasing costs. This influx of new entrants is fostering competition and innovation, leading to the development of more cost-effective mid-size satellite solutions. As a result, the market is likely to expand, with a projected growth rate of around 7% annually over the next few years. This dynamic environment suggests that the Mid-Size Satellite Market will benefit from diverse offerings and enhanced capabilities.

Advancements in Satellite Technology

Technological innovations are significantly influencing the Mid-Size Satellite Market. Recent advancements in satellite design, propulsion systems, and miniaturization have enhanced the capabilities of mid-size satellites. These improvements allow for more efficient operations and reduced costs, making them attractive options for various applications. For instance, the integration of artificial intelligence and machine learning in satellite operations is streamlining data processing and analysis. As a result, the market is expected to grow at a compound annual growth rate of around 8% over the next five years. This trend suggests that the Mid-Size Satellite Market will continue to evolve, driven by ongoing technological enhancements.

Rising Demand for Earth Observation Data

The Mid-Size Satellite Market is witnessing a surge in demand for earth observation data. Various sectors, including agriculture, forestry, and urban planning, increasingly rely on satellite imagery for decision-making and resource management. The market for earth observation satellites is expected to grow significantly, with estimates suggesting a value of over 5 billion USD by 2027. Mid-size satellites, with their ability to capture high-resolution images and monitor environmental changes, are particularly well-suited for these applications. This trend indicates that the Mid-Size Satellite Market will continue to thrive as more industries recognize the value of satellite-derived data.

Growing Demand for Communication Services

The Mid-Size Satellite Market is experiencing a notable increase in demand for communication services. As businesses and governments seek to enhance connectivity, mid-size satellites are becoming essential for providing reliable communication solutions. The market for satellite communication is projected to reach approximately 100 billion USD by 2026, indicating a robust growth trajectory. This demand is driven by the need for high-speed internet access in remote areas, as well as the expansion of mobile and broadband services. Mid-size satellites, with their optimal balance of size and capability, are well-positioned to meet these requirements, thereby driving growth in the Mid-Size Satellite Market.

Increased Investment in Space Exploration

Investment in space exploration is a key driver for the Mid-Size Satellite Market. Governments and private entities are allocating substantial resources to explore outer space, which includes deploying mid-size satellites for various missions. The total investment in space exploration is projected to exceed 300 billion USD by 2030, reflecting a growing interest in scientific research and commercial opportunities. Mid-size satellites play a crucial role in these endeavors, providing essential data for research and exploration. This influx of capital is likely to stimulate innovation and expansion within the Mid-Size Satellite Market, fostering new partnerships and projects.