Microcontroller Unit Size

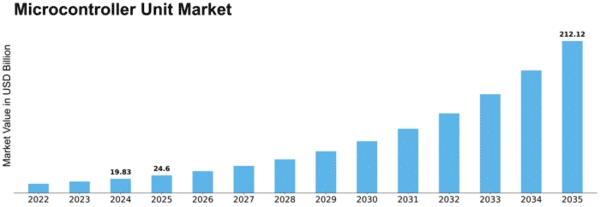

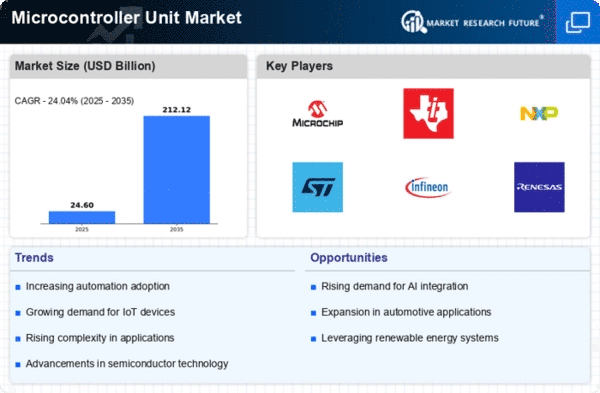

Microcontroller Unit Market Growth Projections and Opportunities

One of the key reasons for the surge in the MCU market size is the rapid use of Internet of Things (IoT) devices. With the world becoming more and more networked, microcontrollers are increasingly being used for powering connected and smart devices, are in great demand. MCUs’ adaptability renders them useful in a variety of important applications, from smart household appliances to industrial sensors. This makes them extremely pertinent components of the burgeoning IoT ecosystem. The most important driver of the MCU market's expansion is now technological advancements. Technology for semiconductors continues to get better, which lets people make microcontrollers that are stronger and more useful. By using the newest technologies in their MCU designs, companies try to stay ahead of the competition and make it possible for devices to do more complicated tasks with less power. The automobile industry has a big effect on the market for MOCUs. The move toward electric autonomous driving, advanced driver-assistance systems (ADAS), and cars (EVs has led to an unprecedented requirement for cutting-edge microcontrollers. MCUs are paramount in the working of various components and parts in modern vehicles, they can be either engine control units or entertainment systems. The competitive environment in the MCU industry has a big impact on market dynamics. Big semiconductor firms are battling intensely for a larger share of the global market by using product differentiation, partnerships, cost-effectiveness, and other techniques. The market's competitive environment is constantly changing as a result of numerous acquisitions, agreements, partnerships, and mergers. When nimble startups and well-established industry titans coexist, reliability and innovation are balanced. This dynamic layer is now present. A key element influencing the MCU market is end-user demands and preferences. Consumer expectations along with their tastes as well as preferences are seeing a huge change, which can be seen in the rising popularity of miniaturization, energy efficiency coupled with connectivity. The demand for microcontrollers that are reliable, accurate, and boast high performance but in a small form is bolstered by products like smartphones, and smart home solutions as well as wearables.

Leave a Comment