Growth of Wine Tourism

The Micro Winery Equipment Market is benefiting from the burgeoning wine tourism sector, which attracts visitors seeking authentic experiences in wine production. As more consumers engage in wine tourism, micro-wineries are positioned to capitalize on this trend by offering tours, tastings, and educational experiences. This influx of visitors not only boosts sales but also creates a demand for specialized equipment that enhances the visitor experience. For instance, wineries may invest in tasting room equipment and visitor-friendly production tools to accommodate larger groups. Market analysis suggests that wine tourism has grown by approximately 25% in recent years, indicating a robust opportunity for micro-wineries to expand their operations. This growth in wine tourism is likely to further stimulate the Micro Winery Equipment Market.

Rising Demand for Craft Wines

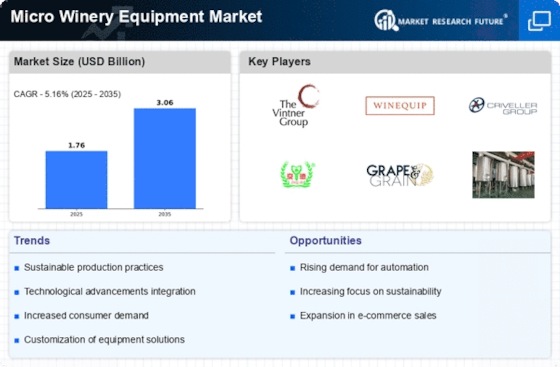

The Micro Winery Equipment Market is experiencing a notable surge in demand for craft wines, driven by changing consumer preferences towards artisanal and locally produced beverages. This trend is reflected in the increasing number of micro-wineries, which have proliferated in various regions. According to recent data, the number of micro-wineries has grown by approximately 20% over the past five years, indicating a robust interest in small-scale wine production. As consumers seek unique flavors and personalized experiences, micro-wineries are capitalizing on this trend by investing in specialized equipment that enhances the quality and distinctiveness of their products. This growing demand for craft wines is likely to propel the Micro Winery Equipment Market, as producers require advanced tools and technologies to meet consumer expectations.

Technological Innovations in Winemaking

Technological advancements play a pivotal role in shaping the Micro Winery Equipment Market. Innovations such as precision fermentation, automated bottling systems, and advanced filtration techniques are revolutionizing the winemaking process. These technologies not only improve efficiency but also enhance the quality of the final product. For instance, the integration of IoT devices allows winemakers to monitor fermentation conditions in real-time, leading to better control over the wine's characteristics. As the industry embraces these innovations, the demand for modern micro winery equipment is expected to rise. Market data suggests that investments in winemaking technology have increased by 15% annually, indicating a strong trend towards modernization in the sector. This technological evolution is likely to drive growth in the Micro Winery Equipment Market.

Sustainability and Eco-Friendly Practices

Sustainability has emerged as a critical driver in the Micro Winery Equipment Market, as consumers increasingly prioritize eco-friendly practices. Many micro-wineries are adopting sustainable methods, such as organic farming and energy-efficient production processes, to appeal to environmentally conscious consumers. This shift is not merely a trend; it reflects a broader societal movement towards sustainability in food and beverage production. Data indicates that approximately 30% of consumers are willing to pay a premium for sustainably produced wines, which incentivizes micro-wineries to invest in equipment that supports these practices. As a result, the Micro Winery Equipment Market is likely to see a rise in demand for equipment that aligns with sustainability goals, such as solar-powered systems and biodegradable packaging.

Increased Investment in Small-Scale Production

The Micro Winery Equipment Market is witnessing a rise in investment directed towards small-scale wine production. As the popularity of micro-wineries continues to grow, investors are increasingly recognizing the potential profitability of this niche market. Data shows that funding for micro-winery startups has increased by 40% over the last three years, reflecting a strong belief in the viability of small-scale wine production. This influx of capital enables micro-wineries to acquire advanced equipment that enhances production capabilities and product quality. Furthermore, as more individuals enter the wine-making business, the demand for specialized micro winery equipment is expected to rise. This trend indicates a promising future for the Micro Winery Equipment Market, as it adapts to the evolving landscape of wine production.